Market Outlook

The only certainty in the near term seems to be more uncertainty. Some good news is that it was reported that China and US initial trade talks in Switzerland yielded some positive comments on progress, but deals will take months and the chance that one party resists. Even with a fast-track deal, the supply chain disruption cannot be avoided. We believe still that the interest rate tailwind of slower global growth will support REITs in Asia especially Australia, Singapore and even Hong Kong (see fall in HIBOR). CPI in our region outside of Japan has trending very much in the right direction. We continue to like the themes in sectors and countries where we are already positioned. In Australia, we own residential related names like Mirvac and Stockland, asset managers, self-storage, and other specialty sectors. In Singapore, our picks have helped with retail heavy Fraser Centrepoint Trust and CICT among top performers along with Healthcare REIT, Parkway Life. In HK, we prefer REITs over Developers but see some value in large cap SHK and continue to overweight Retail REITs, HK Land and SUNeVision. In Japan, we also prefer REITs over Developers as the relative cheapness of Developers has gone away. More detail below on justification for our positions and upcoming catalysts.

Japan

While it sounds cliché to say “sell in May and go away” for the Developers, there are some good reasons for this. May is when the largest Developers report full year earnings and often announce mid-term plans and new corporate governance targets. As a result, there is a lot of excitement going into the results. In addition, payout ratios and targets have been raised substantially so we see a limited scope for more improvement for most of the names with a few exceptions. However, until the second quarter results which are reported in October, we will not be likely to get earnings forecast upgrades or catalysts. As we have commented often, we fear that higher construction costs will impact future development feasibility. In short, we think landlords are better positioned in this environment. As such, we have added to Japan RE (8952), a large office REIT. JRE has mostly 5-year fixed leases which means we can expect rental uplift as market rents are above in place (passing) rents. We continue to like Diversified names with hotel exposure and like the Hotel REITs as well despite the recent strength in the JPY. Logistics has been the biggest disappointment for us, but earnings have shown reasonable strength and REITs like GLP JREIT have raised rents, exercised CPI clauses, and got decent growth on renewals. Again, construction costs here are a factor, so we expect a sharp reduction in supply to help sentiment as the vacancy rate improves in the second half in Tokyo. The current oversupply is not in areas that threaten the logistics JREITs we own.

Australia

Over the last month, AREITs have staged a remarkable recovery and have risen 12%, erasing the YTD loss. The market has been bifurcated with large cap Goodman Group (GMG) providing much of the index loss while residential related, office, asset managers like Charter Hall, had double digit returns. GMG was very oversold based on the surprise capital raise of AUD 4bn and due to concerns about hyperscaler capex in the DC business. While we would be surprised to see GMG’s recovery continue, we still see it as a funding vehicle for investors who wanted to get exposure to the value side of the REIT sector. We continue to favor names like Stockland and Mirvac as we anticipate residential volumes to recover as the RBA cuts throughout the year. As we mentioned last month, Abacus Storage King received a conditional takeover offer at 1.47 by its major shareholder, KI Corporation, and US Self Storage Giant, Public Storage. We took advantage of the move and sold our position at a narrow discount to the proposed price and consolidated our self-storage holdings by adding to our position in National Storage. Curiously, the shares are now trading slightly above the takeover price, possibly due to the news that National Storage itself took a 5% position in ASK. While it is unlikely they will announce a rival bid, the expectation is they may push for a higher price rather than trying to disrupt the takeover. KI Corporation cannot vote in the transaction so it would not take much to block the deal. We are positive on self-storage due to our expectation of a recovering housing market, continued population growth, and potential for more consolidation of unlisted, smaller players. We are seeing more optimism on clearing in the office sector especially for high quality assets and this supports our view on asset manager, Charter Hall Group, which has also noted capital rotation out of US assets into Australian private RE.

Hong Kong and Singapore

Below was our comment on Hong Kong last month. Indeed, there has been a strong recovery in Hong Kong REITs for the reasons cited below. As the HKD rallied to the strong side of the band and liquidity came into Hong Kong Hibor 1m fell to 1.9%. The FTSE EPRA Nareit HK Index has risen 17.2% over a one-month period and has now delivered 12.51% YTD. We still see catalysts like HK Stock Connect as positive but also recognize that macro factors like USD strength or weakness will play an especially significant role and that depends on overseas factors.

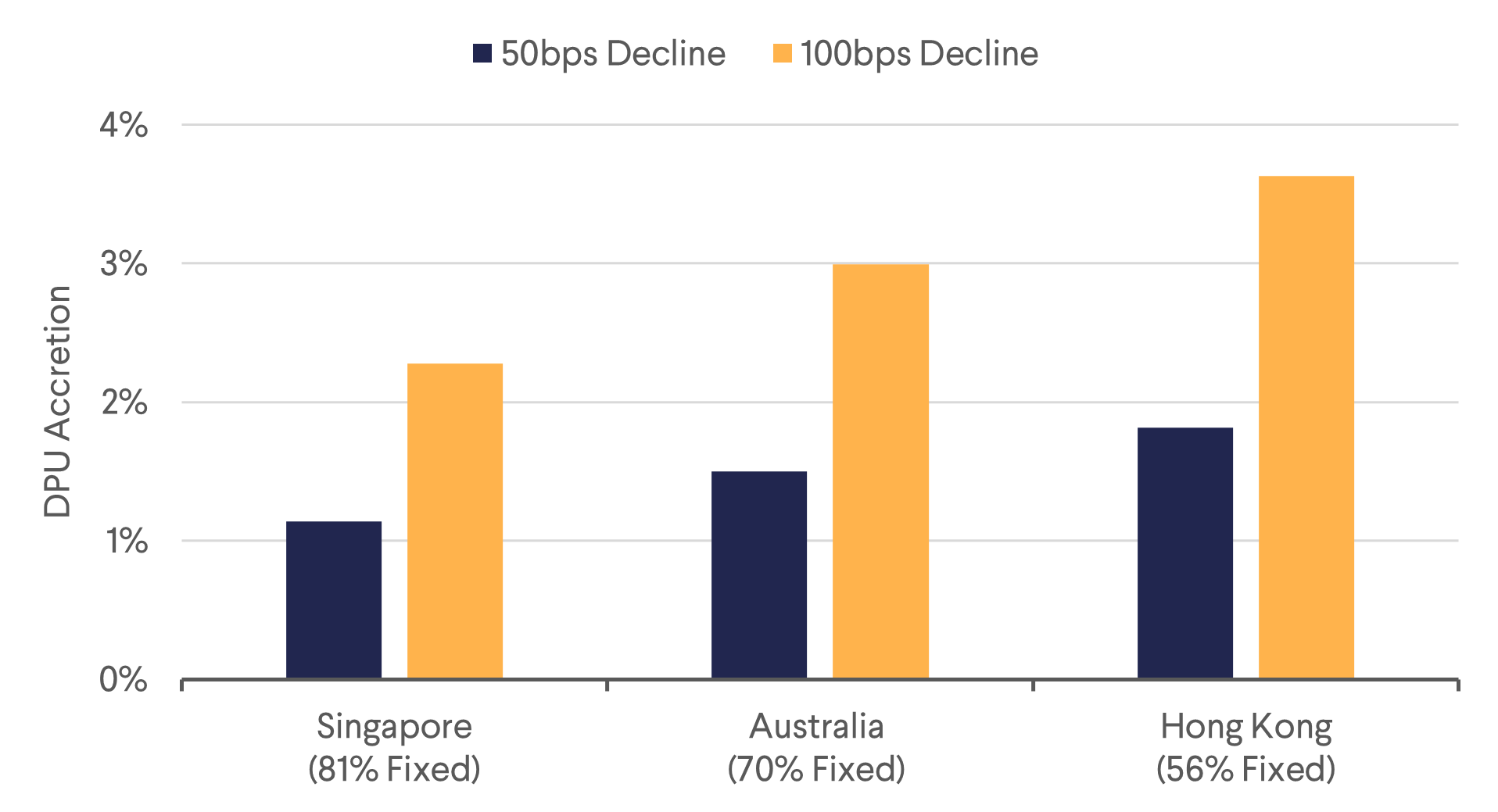

“Despite the sharp fall in Hong Kong property stocks following the Chinese trade tariff retaliation, we see several drivers to support the HK REIT sector as well as HK Developers/Investors. HK REITs have a sizable percentage of their debt based on 1-month HIBOR and that rate has fallen to 3.45% from the mid fives at the end of 2023. Every 100bps average drop translates into roughly 3.5% increase in DPU growth for the sector. In addition, we expect the HK Stock Connect to include HK REITs very soon and likely candidates are Link REIT and Fortune REIT. A falling HKD could also reduce some leakage in retail sales to overseas markets and help attract some tourists as well, which would be positive for retail sales. HK Developers are challenged by low margins and have faced a large supply. Given the Government reduced land sales in the past year and strong increase in volumes thanks to the removal of Stamp Duties on foreign buyers, there has been a clearing of inventory. Falling mortgage rates will also help. We prefer REITs over Developers at the moment but could see a recovery in both groups once the dust settles. We also anticipate strong stimulus from the Chinese Government to offset the impact of tariffs which could improve sentiment in Hong Kong as well.”

NTM DPU Impact of Floating Rate Decline

SREITs have risen only 1.17% in local currency terms. However, performance has been bifurcated with Fraser Centrepoint Trust, Parkway Life REIT and CICT rising between 10-13% with many other large caps down for the year. We are overweight Singapore as we see continued drops in funding costs which will help earnings and fuel acquisition growth for some names that have strong costs of capital. With 1Q updates behind us, we see limited negative catalysts for the sector and expect some rotation from the banking sector into SREITs as the outlook for net interest income margins becomes weaker as rates fall. We will stick with our current positioning but lower our exposure to hospitality

Download the PDF version of the report here