The BOJ ended its Negative Interest Rate Policy (NIRP) and stopped its Yield Curve Control (YCC). What will be the impact on JREITs and the Real Estate sector as a whole?

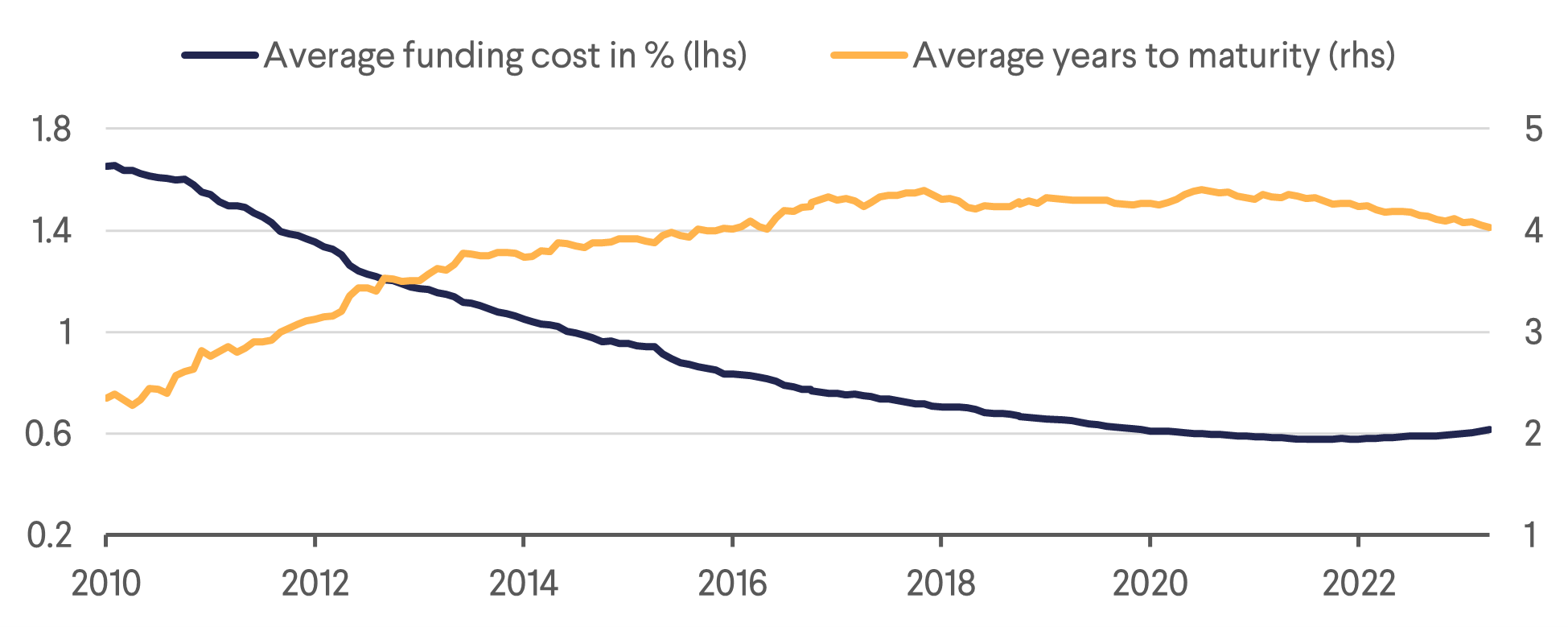

The ending of NIRP and YCC was well anticipated by market participants. JREITs have been under severe pressure since the BOJ changed its YCC policy in December 2022, and we have already seen funding costs rise alongside longer duration Japanese Government Bonds (JGBs) since the BOJ tweaked their YCC policy. For example, prior to the first change JREITs could access 5–7 year debt between 40-70bps (all-in) depending on the issuer and duration. Today, rates for such borrowings have already increased somewhat but still possible to tap 5 year money below 1% for some issues. For example, on 21 March KDX Realty announced it raised 5 year money at 0.87%. As a result of the higher base rate, we expect some increase in interest expense but the impact will be very moderate as JREITs generally have longer duration debt compared to other Asian REITs and most is fixed. JREITs can mitigate some of the interest cost increases by borrowing shorter duration or using floating debt which is based on 3m TIBOR with a spread of approximately 25 bps for some. While this may introduce some risk given the prudence that the JREITs have exhibited when rates were low, it makes perfect sense that the JREIT managements lower some duration and increase floating rate exposure. Most JREITs have an average of 4-year debt duration and it is common that over 90% is fixed. We expect a very limited impact on earnings from here as funding costs already moved well before the BOJ moved on NIRP and the impact will lead to only a slight increase in funding cost (see Figure 1).

For the real estate market, we see also limited impact given the solid and improving rental conditions in many sectors combined with large spread versus all-in borrowing rates. We expect transactions to remain very active, unlike other markets where debt costs can exceed sellers’ desired exit cap rates. Residential condo conditions continue to remain tight and the impact from the change on NIRP will not change affordability dramatically, especially for double income households that may even be seeing wage increases. Overall, we see the announcement as no surprise and impact on earnings will be quite limited assuming even future rate increases.

The BOJ also announced they will stop buying JREITs as part of their change in policy. Do you anticipate any impacts of this action on your funds or the sector overall?

We anticipate zero impact on our funds in the short-term and view the action as a long-term positive for our strategy. The BOJ’s last purchase of JREITs was in June 2022 and holds large positions in names that we have historically generally avoided such as large cap Office JREITs. The BOJ has lower exposure (or no exposure) to logistics names or hospitality-related diversified JREITs which we prefer. Over time we do believe the BOJ will need to eventually exit these positions which may hurt the larger names and passive strategies that are market cap weighted.

What is your outlook for JREITs for the balance of 2024?

A lot depends on the global rate environment and the JPY/USD. If rates peak globally and the USD weakens against the JPY we could see this interest rate hike as a “one and done”. The bounce we saw in JREITs must be seen as a relief rally in a very undervalued and oversold sector. JREITs trade at large discounts to NAV despite plenty of market transactions that support appraised values. However, it is too early to say this rally continues until we see some confidence that the BOJ can remain accommodative without risk of higher imported and domestic inflation.

We suspect that we will see the sector drift back in the coming days with Developers continuing to be seen as stronger growth plays with big dividends and improving corporate governance. Mitsubishi Estate is likely to announce a more sustainable buyback and Sumitomo Realty is likely to remove its poison pill once legislation they are waiting for is passed. Having said that, we still like logistics due to its solid growth and is a beneficiary of labour constraints in the transport sector (shorter working hours) driving demand for efficient, modern, and well-located facilities in addition to falling future supply. We also like diversified REITs with exposure to B grade office and hospitality assets, and residential JREITs while we dislike non-discretionary retail and large A- grade office REITs. While the BOJ move removed a short-term overhang, we expect a new one to appear until other global central banks start to ease which will take pressure off the JPY and reduce imported inflation.

Download the PDF version of the report here