Entering a Better Cycle

Last week we attended the annual EPRA conference in Berlin, which brought together key players in the European listed real estate market.

Over the course of the event, we had one-on-one and group meetings with various companies, visited Vonovia properties and attended the EPRA Regulatory & Tax Committee Meeting. Given the strong recent share price performance (EPRA Index +14% total return in last six months), and a continued downward trend in interest rates, the sentiment among investors and management teams alike was markedly improved compared to previous years. Management teams expressed optimism that the negative cycle of declining property values, elevated leverage, and a subdued transaction markets may be at its end.

The challenging period over the past two years forced REITs to prioritize balance sheet resilience over growth and was marked by weak share price performance as shares discounted the drop in physical prices.

A key takeaway from the conference is that there are increasing signs that the real estate sector is moving back into a positive cycle. Half-year results showed a stabilizing trend in property values, with certain markets even experiencing growth. However, these trends are still early,investor interest is rising, even though confirmed transactions remain limited.

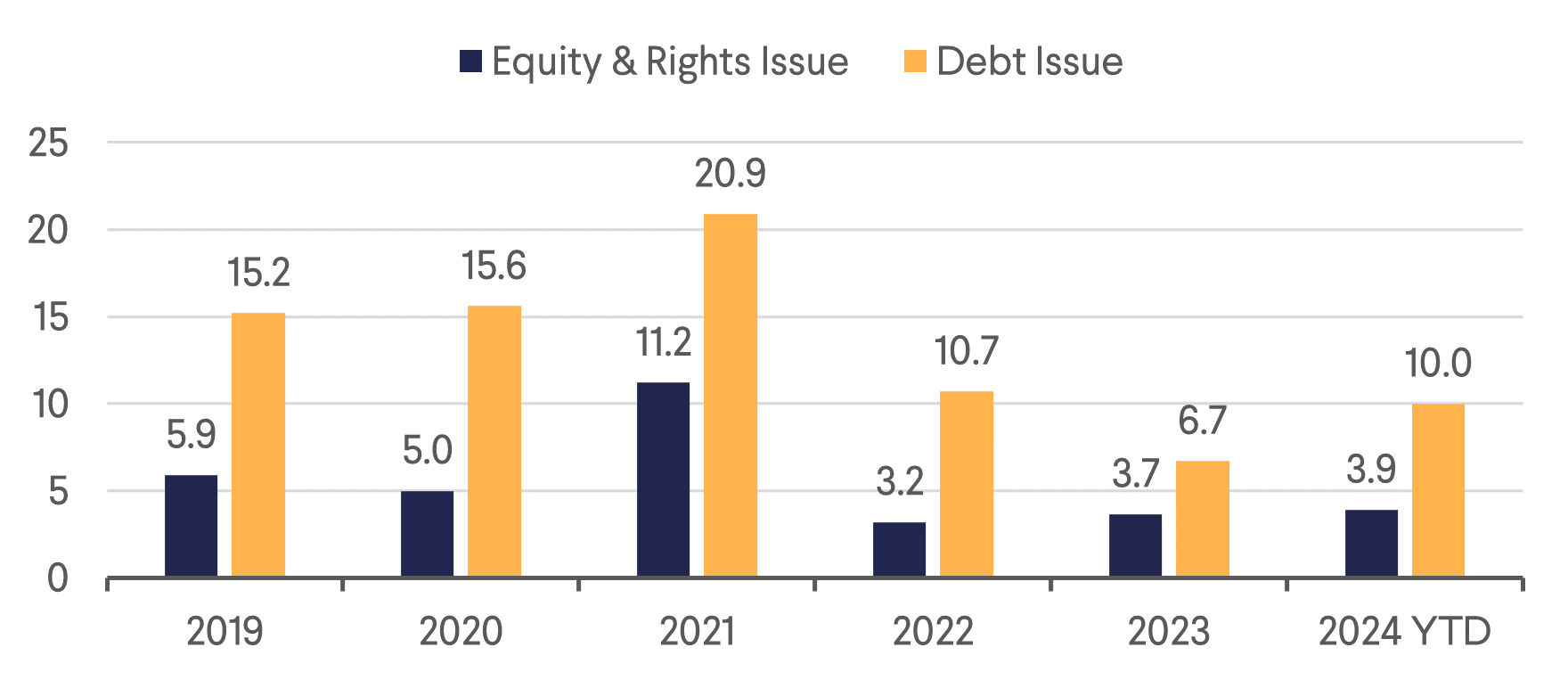

Management teams across different property sectors expressed increased confidence that values have troughed or are close to do so and that the time has come to refocus on growth. To enhance the sector’s currently moderate earnings growth, external growth will be crucial.Refinancing cheap in-place debt at higher rates and disposals to reduce leverage remain headwinds which offset solid rental growth. However, access to debt and equity has improved as shown by equity issued year-to-date which already tracks ahead of the previous two years (see Figure 1) and REITs are finding attractive acquisition opportunities.

Market expectations are still for negative earnings growth of -1% in 2024 but are already looking to a resumption of +4% earnings growth in 2025. Lower interest rates, less disposals and more acquisition activity could further improve the outlook.

Figure 1: FTSE EPRA Nareit Developed Europe - Equity & Debt Issued (EUR billion)

On average the sector is trading at a 22% discount to NAV. Within the sector, there is a notable divide in the starting positions of companies as we potentially enter a new cycle. Only 12% of the EPRA index is trading at a premium to the last reported NAV and is thus in a favourable position to raise capital although several companies have already started doing so. Many companies are still dealing with stretched balance sheets and are trading at significant discounts to NAV. They need to find other ways to grow, for example exploring alternative strategies, such as asset-light models (see page 2 on Vonovia).

In the short term, we anticipate the announcement of new growth plans and the normalisation of dividend payments, to act as catalysts for the sector. These catalysts coupled with the re-emergence of external growth options,could improve the sector’s valuation and start a positive cycle of better capital costs and increased external growth. In addition, it would also make IPOs more appealing and help to add further scale and diversification to the listed sector in Europe.

Will Europe Continue to Lag?

Europe has navigated through challenging times marked by the Covid-19 pandemic, the Ukraine war, an energy crisis, inflation, and higher interest rates. Europe’s economy grew less than other regions and listed real estate delivered weaker returns than both US and Asia. After prioritising the Green Deal during the last term, the new EU parliament has realised the urgent need to improve the region’s economic performance and has announced to shift its attention for the next five-year term towards improving the competitiveness of European economies in the global landscape. Policy support would be appreciated, but we remain cautious of what can be delivered. Meanwhile, lower interest rates, which are more relevant for Europe compared to other regions given its higher leverage, help recover it from recent weak performance.

The conference panels on geopolitics and sustainability, served as a reminder that despite positive trends substantial risks and uncertainties persist. The unresolved conflict in Ukraine continues to cast a shadow over the region and the way to net zero carbon emission remains challenging and costly, while many published goals remain hard to achieve on time.

While macroeconomic factors are very important for real estate markets, they do not translate one-to-one to stock price performance. There are many examples of companies that through niche positioning, superior operations, or unique business models managed to generate attractive returns even in challenging environments. We met, for example the CEO of Sirius whol aid out why his company focused on German and UK business parks managed to perform wellthrough difficult markets. A strong in-house team along the whole value chain, from leasing to acquisitions as well as a good understanding of its tenants are key success factors.

German Residential – How Can We Grow?

German Residential was a big focus of investors as the conference was hosted in Berlin. We participated in a property tour and met the management teams of Vonovia and TAG. Both companies have marked down the values of their portfolio by 15-20% since the peak in mid-2022and focused on reducing leverage, but now think the disposal phase is ending. Vonovia is in the process of completing this year’s EUR 3bn disposal target and wants to communicate its growth strategy later this year. TAG Immobilien is expected to reinstate its dividend which has been suspended since 2022, by providing an update with Q3 2024 results.

Vonovia generates solid and very steady rental growth. The rental regulation in Germany limits the annual like-for-like rent growth to about 2%, also for much stronger markets like Berlin. Companies can boost the growth rate by modernization capex, which in the case of Vonovia brings the expected rental growth to about 4%. Unfortunately, this growth will be neutralised by higher interest expenses as cheap debt matures, leading to a modest earnings growth outlook in the coming years. As raising capital remains highly dilutive, Vonovia is looking at capital-lightways to grow.

Vonovia is already much more than just a property owner, running a big craftsmen organisation, a developments business, and offers various services to its clients. This platform could be further leveraged in a capital-light way by, for example, bringing in third party capital, but we will have to wait for the company’s capital markets day in October to get more details on how Vonovia wants to grow in the near future.

TAG Immobilien successfully expanded to Poland beyond its strong footprint in Eastern Germany and still sees Poland as its best way to allocate capital and generate growth. In Poland, TAG combines a self-financing development business with building up a rental portfolio with a target to reach ten thousand units by 2028. The Polish market is much less regulated than Germany and recently witnessed much higher rent growth of 10-20% and sales price growth of 20% over the previous two years. The influx of people from Ukraine and subsidy programs for first time home buyers provided strong drivers for the rental and sales market. These trends are slowing, but TAG still see attractive growth in Poland for years to come by investing in new apartments with a yield on cost of 7% to 8%.

|  |

| Figure 2: Vonovia Property Tour - Guineastrasse, Berlin Before Modernisation | Figure 3: Vonovia Property Tour - Guineastrasse, Berlin After Modernisation |

Download the PDF version of the report here