B&I Capital visited two of Link REIT’s malls in Tin Shui Wai (New Territories HKSAR) and Link CentralWalk Mall in Futian (Shenzhen) over the first two days of August. We also visited other retail assets in Shenzhen including two downtown destination malls and Sam’s Club and Costco. Link REIT currently trades at a forward DPU yield of 7.7% and 0.49x Price/Book versus an average of 4.0% forward yield and 0.96x Price/Book from 2014-2018.

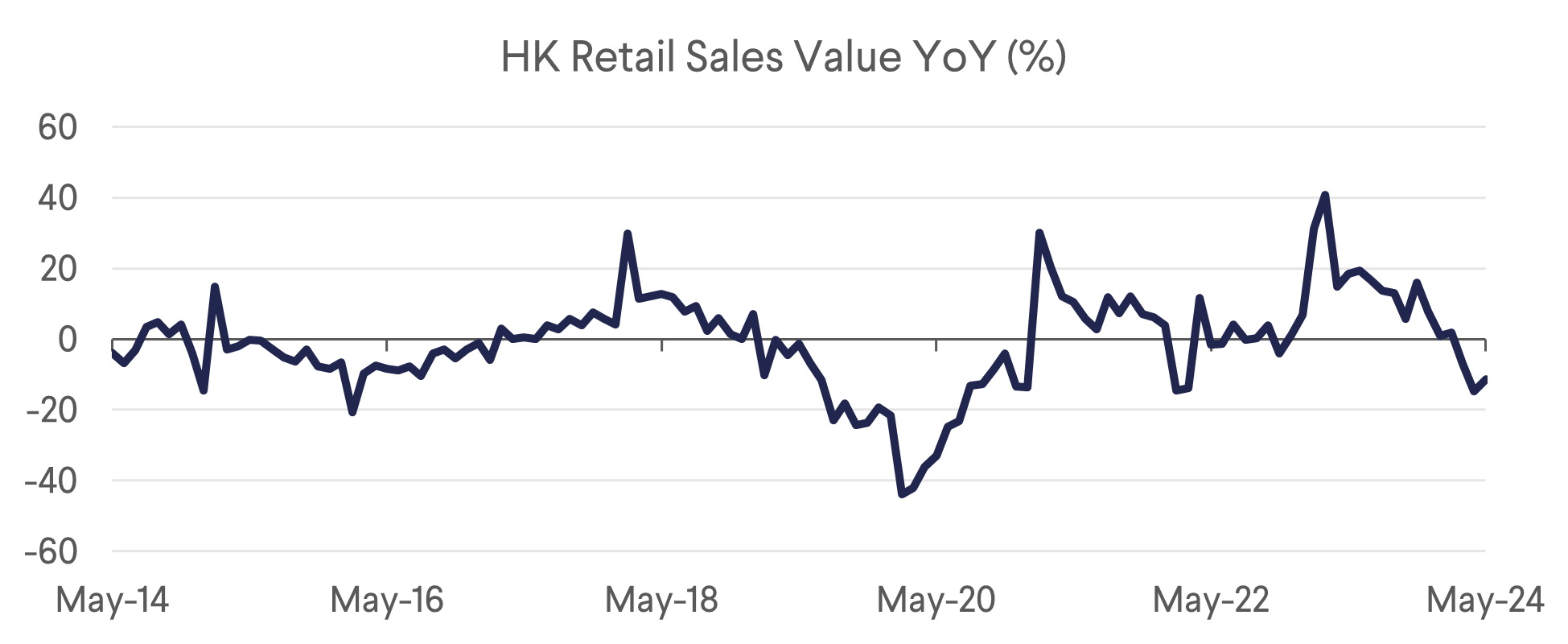

Since 3Q23, the overwhelming investment narrative on Hong Kong retail has been of northbound travel and spending leakage from HK residents to Shenzhen. Citi reports that the average weekend HK visitation to Mainland China (i.e. Shenzhen) has reached 530,000 per weekend in the 2Q24 (roughly 110% of 2018 levels) and the HK headline retail numbers have suffered this year: -6.6% YoY in 1H24 while June retail sales were -9.7% YoY, this was better than analyst predictions of -15% and an improvement on the -11.5% and -14.7% retail sales of May and April, respectively.

So, is the death of HK retail spend only a matter of time or is this theme just, as Macbeth says, “a tale told by an idiot, full of sound and fury, signifying nothing”?

The retail leakage narrative is reality, has increased from pre-2019 levels and are structural, but the long-term effect on HK retail is more category specific than a complete wipeout of HK retail trade. Some, not all, of the cheaper prices found in Shenzhen is due to the strength of the HKD (+13% since April 2022) against the RMB over the past two years, though this has reversed in the past week from the start of our visit (RMB +1.6%).

Also, some of the poor YoY retail numbers over the last Quarter have been due to a high 2Q23 base affect which included HK/China Covid re-opening and a government retail voucher program that stirred up spending.

Since the mainland border re-opening, the most affected retail sectors in HK have been experiential trades along with restaurants and some dry goods at grocery stores. We saw firsthand going to a high-end Chinese restaurant Lei Garden at Elements Mall (TST) that was empty on a Friday evening at 8pm. However, Link’s HK fresh markets are almost not affected as it is illegal to import raw meat and fish back to Hong Kong. White and bulky goods, while up to 50-70% cheaper at Sams Club and Costco in Shenzhen, are also rarely imported back to Hong Kong due to transportation difficulties (most travellers still go by train and MTR) and lack of warranties in Hong Kong. The price differential and offerings of luxury bags, clothing and cosmetics are not substantial, and we were told that Shenzhen doesn’t represent significant competition in these categories; in fact, we didn’t see any luxury tenants at the malls we visited. Luxury item sales in Hong Kong (-13% YoY in 1H24, 39% below 2018 levels) have been hurt more by the huge increase of travel to Japan directly due to the weak Yen. If the surge in the Yen over the past month holds, the HK retail leakage to Japan should become less of an issue.

Many of the analysts and property managers we spoke to were predicting the northbound retail spend was plateauing, though firm data evidence has yet to confirm this.

It was apparent from our trip and from speaking with a range of people in Hong Kong, that the focus of the Shenzhen spend is for restaurants and experiential activities (i.e. karaoke, massage, children entertainment). Hong Kong residents are making the trip North as a “friends and family” group outing instead of everyday non-discretionary spend. Dinner at Chinese restaurants can be 50-70% cheaper than HK banquets while having more serving staff and later opening hours (seems like restaurants are closing at 9.30-10pm in HK now).

Travel infrastructure and streamlining the immigration process has lowered the travel time and costs significantly since 2018. The High-Speed Rail (Second Class ticket is HKD60, USD7.70) takes 15 minutes from HK to downtown Shenzhen (passenger volume reached 20m in 2013), while the MTR direct line takes under an hour and costs HKD51 (USD6.55). HK residents and citizens can now clear immigration through electronic gates, saving 40+ minutes from previous manual checkpoints at both borders. Driving cross border has also become easier with online car registration at much lower costs. Though overwhelming majority occurs by train or group buses, which makes it unlikely for Hong Kongers to bring back bulky goods.

Shenzhen weekend visits have been particularly appealing for the HK middle class. Link’s management even explained that their malls closest to the Chinese border (T Town and Tin Shui Shopping Centre) which primarily serves lower income brackets have been less effected than mid-market malls.

Finally, it’s important to note that Link REIT’s management has adapted through tenant remixes and asset Asset Enhancement Initiatives (AEI) throughout its Hong Kong portfolio to contend with Northbound travel leakage. No doubt it has come from a position of strength as the portfolio is focused on non-discretionary retail centres located in the heart of residential communities. Link’s performance numbers last year have borne out this success: HK retail occupancy is at an all-time high, FY3/24 rental reversion healthy at +7.9%, car park revenue +3.4% and tenant sales continue to “outperform significantly” the overall weak HK retail numbers in the 2Q24. The issues with Link REIT over the past decade has been investing away from their home markets of Hong Kong and Southern China to London and Australia.

B&I Capital remains overweight to non-discretionary retail in Hong Kong for its inexpensive valuation and defensiveness.

T Town (Link REIT)

We visited Link REIT’s T Town (3 Floors, 207,000sqft NLA, HKD5.8b valuation at 4.7% cap rate) on a Thursday afternoon and found a busy and well trading mall. It is in Tin Shui Wan with a catchment of 280,000 and a district bordering China (it is Link’s closest mall to the border). TSW’s household income is c9% below the HK average (HKD27,650/month) but is one of the highest growing income districts (+18% YoY) in HK. This catchment growth has insulated T Town from any major effect of retail leakage Northbound.

T Town has undergone 3 AEIs over the past twelve years: 2012 and 2016 were both major initiatives while last one was smaller in 2021, and all achieved Link’s 12% ROI hurdle on capex spend. The tenant mix (more focus on non-discretionary, daily good needs) at its T Market (shown in the pictures) and strong positioning amongst residential community has made T Town one of the top 5 productive malls by sales/psf in the Link portfolio. Occupancy cost is below the 12.5% Link REIT average while having one of the highest rental rates. Tenant sales continue to be positive YTD. Furthermore, Link management said that T Town’s two Chinese restaurants were performing profitably, and they have added fashion and jewellery tenants since COVID.

|  |

|  |

Link CentralWalk

Link CentralWalk mall was developed in 2007, and Link REIT acquired it in 2019 and is its only asset in Shenzhen. The 84,000sqm retail mall has 4 levels and connected to two Shenzhen Metro lines which includes the oldest and busiest Line 1 in the city. It is also surrounded by 40 Grade A office and hotels so draws foot traffic from all four customer quadrants – CBD office workers, local families, business travellers and weekend tourists (Link management estimates that HK tourists are from 50-70% of the weekend crowd currently). Link completed a major HKD300m (USD30.5m) to improve the general mall presentation and tenant remix in late 2021 and completed a smaller AEI at the basement level that recently opened in late 2024. Both achieved double digit ROIs and increased F&B tenancy to 39% (from 24%) of Net Lease Area (NLA) while decreasing low paying supermarket NLA from 35% to under 5% with a new, first to market boutique grocery store. Link also increased overall leasable NLA by 600sm.

Link REIT’s China assets (six retail, five logistics and one office) now represent 11.6% of portfolio revenue.

Link CentralWalk was valued at Rmb4.66b and 4.65% cap rate at September 2023 FY end. This compares with HK 6.6b (Rmb6.1b) acquisition price, with the 30% write-down in RMB due to lower NOI and 50bps cap rate expansion over the past five years. Valuations will now have stabilised with tenant sales +30% YoY in 2Q24 and set to grow further with the opening of its basement AEI finishing the last week of July 2024.

CentralWalk’s foot traffic has increased to 100,000 on peak days from 40,000/day pre-Covid. They claim that at current RMB 2,000 sales per square foot, it is now the most productive Mall in China. Occupancy costs have fallen to the low teens versus low 20%s for tier one cities. Carrefour departed from the basement level but has been 95% backfilled with higher rent paying F&B, fast fashion tenants and boutique grocer; leading to a mid-single digit Yield on Cost (YoC).

|  |

| Link CentralWalk is an older mall for Shenzhen, but the interior looks as new as any asset we visited. Interestingly, the mall management mentioned that they have added bars (picture to the left) that open until 2am as there is a clientele of both local and Hong Kongers who want to party in Shenzhen. |

| The atrium of the basement level of Link CentralWalk which re-opened a week before our visit, 95% leased after the recent departure of Carrefour (7,000sqm). Link brought in 50 new brands and rents are up 30% from Carrefour and over 20% ROI achieved on the HKD24m capex. |

Coco Park

Coco Park is a mall in the direct vicinity of Link CentralWalk which we visited on the same trip. CentralWalk with a midmarket retail focus and F&B and late evening bars is positioned very differently than both. Coco Park (80,000sqm and 250 tenants) was bought by China Resources in 2023 and we could see during the site visit a mall that is well let (96% occupancy) and focused on a higher end trade mix with first floor cosmetics/beauty (first photo), second floor fashion focused and outside courtyard dining (though not many bars were seen).

|  |

Wongtee Plaza

Compared to Coco Park, Wongtee Plaza is closer to Link CentralWalk but we were told is trading worse than both CentralWalk and Coco Park. Current owner is looking to sell and thus tenanting on short-term leases for immediate cashflow. The mall’s historical emphasis on EV tenants is not working well in the current environment and we saw several vacant units on the first floor.

|  |

Costco

We visited Costco Shenzhen which opened in January 2024 and has 225,000 members paying RMB299 annually, of which 20% are HK residents. The model is like Costco USA selling everything from white goods, clothing and meats/produce in bulk along with an eye care/hearing aid section. Price discounts to HK were anywhere from 20% (alcohol) to 70% (Sony Bravia 85” flatscreen). However, it is unlikely for HK consumers to shop weekly at Costco for food and purchase white goods due to transportation difficulties, high delivery fees, lack of HK warranties and the HK ban on importing raw food. As the novelty factor wears off, we believe that the number of HK resident members will come down to 10% (similar to Sam Club’s HK membership).

|  |

Sam’s Club

This is the first Sam’s club opened in China, over 20 years ago. Management claims it’s the #1 asset by sales productivity in the world for Sam’s Club. The presentation, layout and of white goods, F&B and children’s Stock Keeping Units (SKU) were far superior to the smaller Costco. Foot traffic was strong on a Friday early afternoon but geared more towards local population.

Despite the price deferential existing a decade ago, the Hong Kong retail market had thrived while Sam’s Club was open prior to Covid. This history gives confidence that Link’s discretionary retail assets with continued investment and proper remixing of affected tenant categories can still achieve healthy income growth in a more integrated HKSAR-Mainland China future.

|  |

| Lastly, the HKD100 (USD13) voucher that can be used at F&B or retail outlets in Hong Kong. The HK Tourism Board is doing its part in trying to boost overall retail spend. |

Download the PDF version of the report here