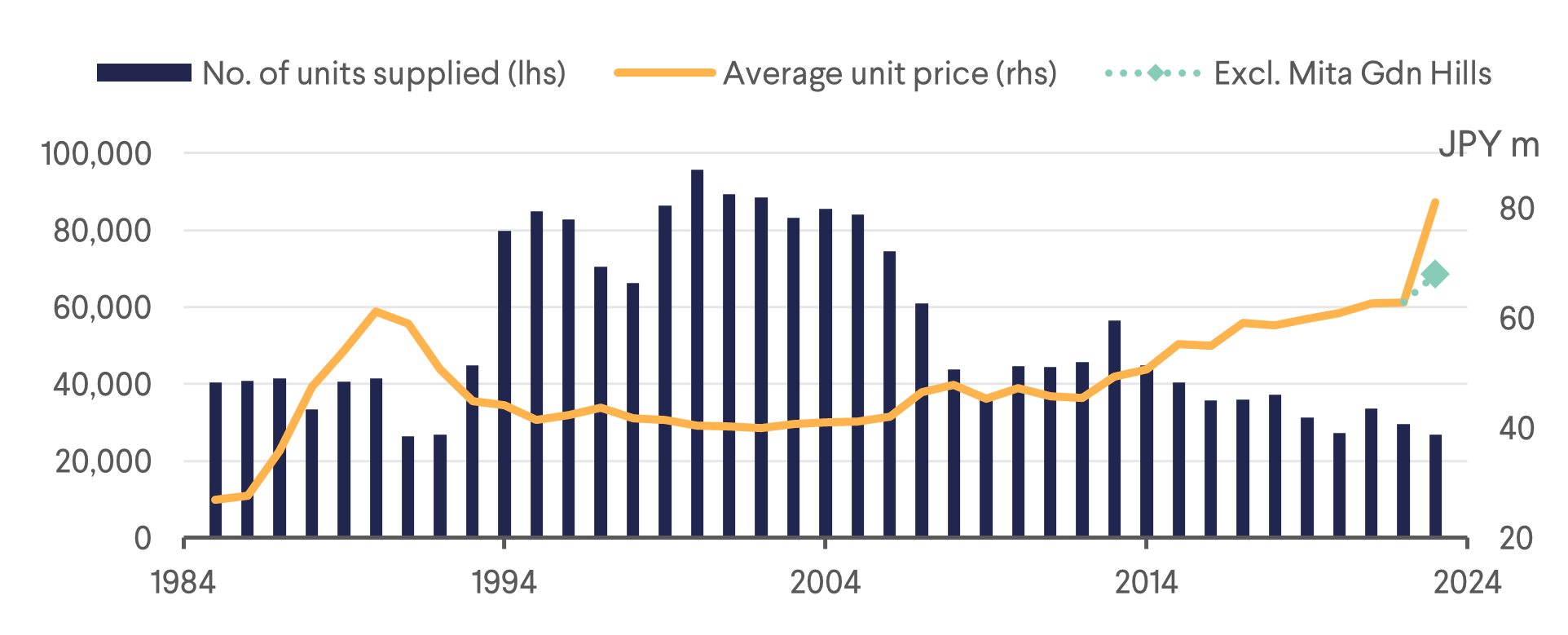

Dislocation Between Fundamentals and Unit Prices

In our piece in December 2023 after attending a conference in Tokyo, we wrote that managements were the most bullish we have seen since the pandemic, and that they are switching to focus on raising rents instead of occupancy, especially in the retail and office sectors.

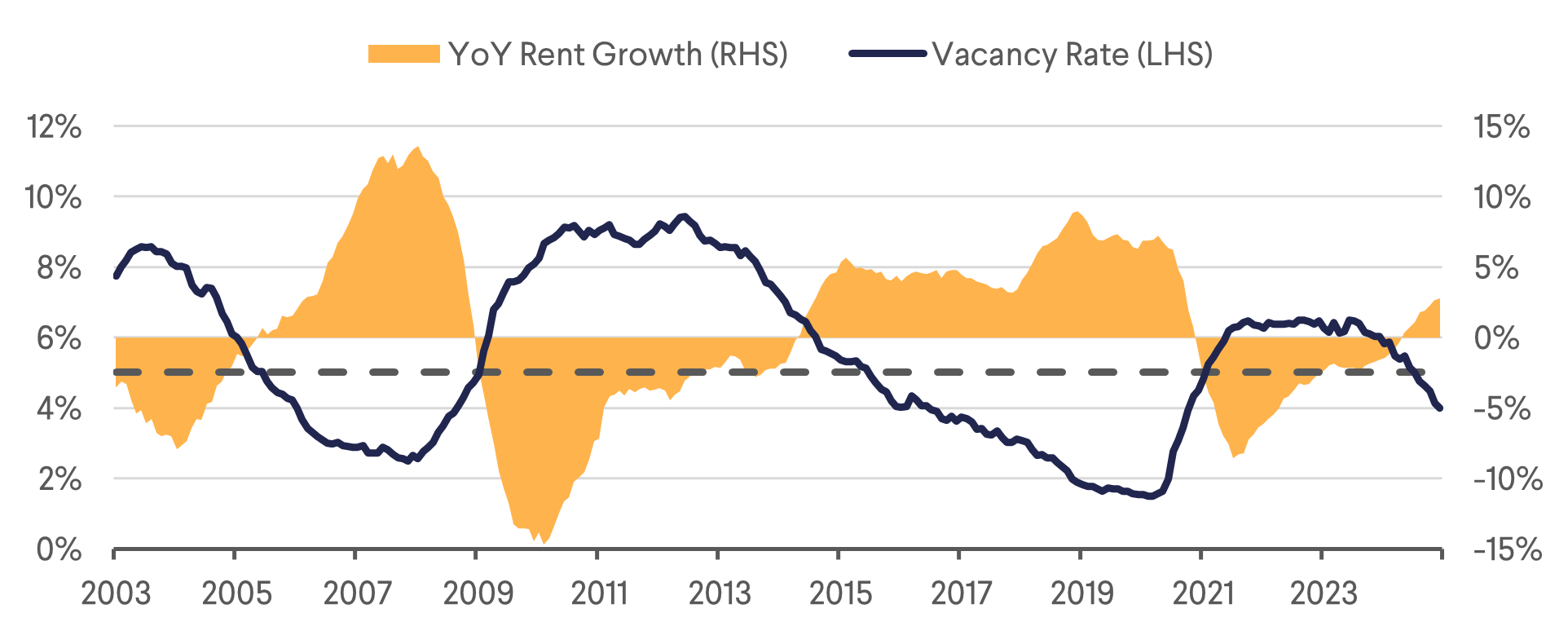

Since then, real estate fundamentals have largely played out in line with managements’ expectations, if not better. Office vacancies in central Tokyo have fallen to 4.0% from a post-pandemic peak of 6.5%, and average asking rents YoY growth has turned positive since May last year. Mitsui Fudosan (8801) reported signing rents at 10-15% higher on renewals. Meanwhile, urban retail sales are >10% higher than pre-covid in many cases and hotels are seeing record ADR levels far above pre-pandemic levels. Despite a high single-digit vacancy in the Tokyo logistics market, the JREITs’ portfolios are essentially fully occupied with occupancy in the high 90’s and achieving rent hikes on lease renewals and tenant replacements with little to no downtime.

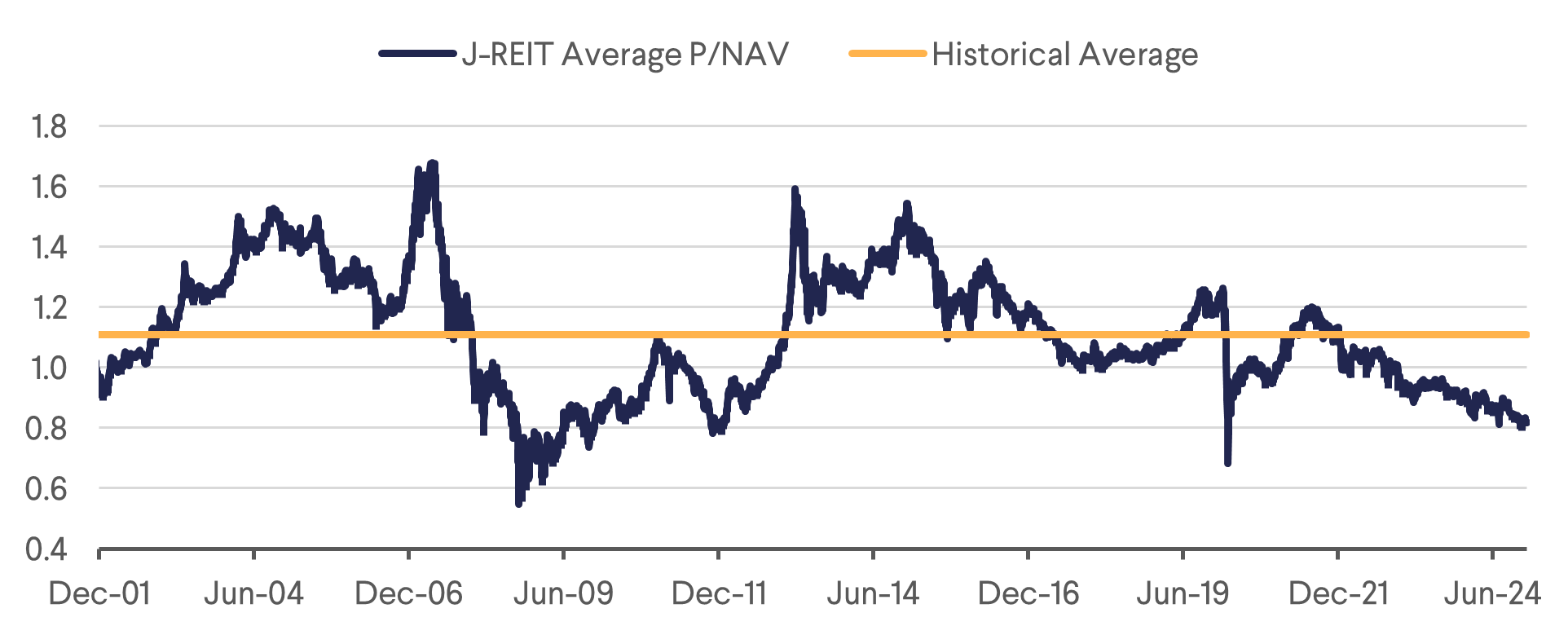

The J-REIT unit prices unfortunately have not been moving in the same direction. The J-REITs are now trading at an average discount of 20% to their NAV based on appraisal values, representing a massive disconnect between the public and private markets. Real estate transactions continue to be healthy and cap rates remain steady, despite the prospect of BOJ tightening. Blackstone invested $7.7 bn in Japan in 2024, citing good economic fundamentals and falling supply, also expecting rate hikes to be moderate and having little impact on the deals outlook. Many J-REITs are taking advantage of this dislocation to sell non-core assets to recycle into better properties or fund unit buybacks.

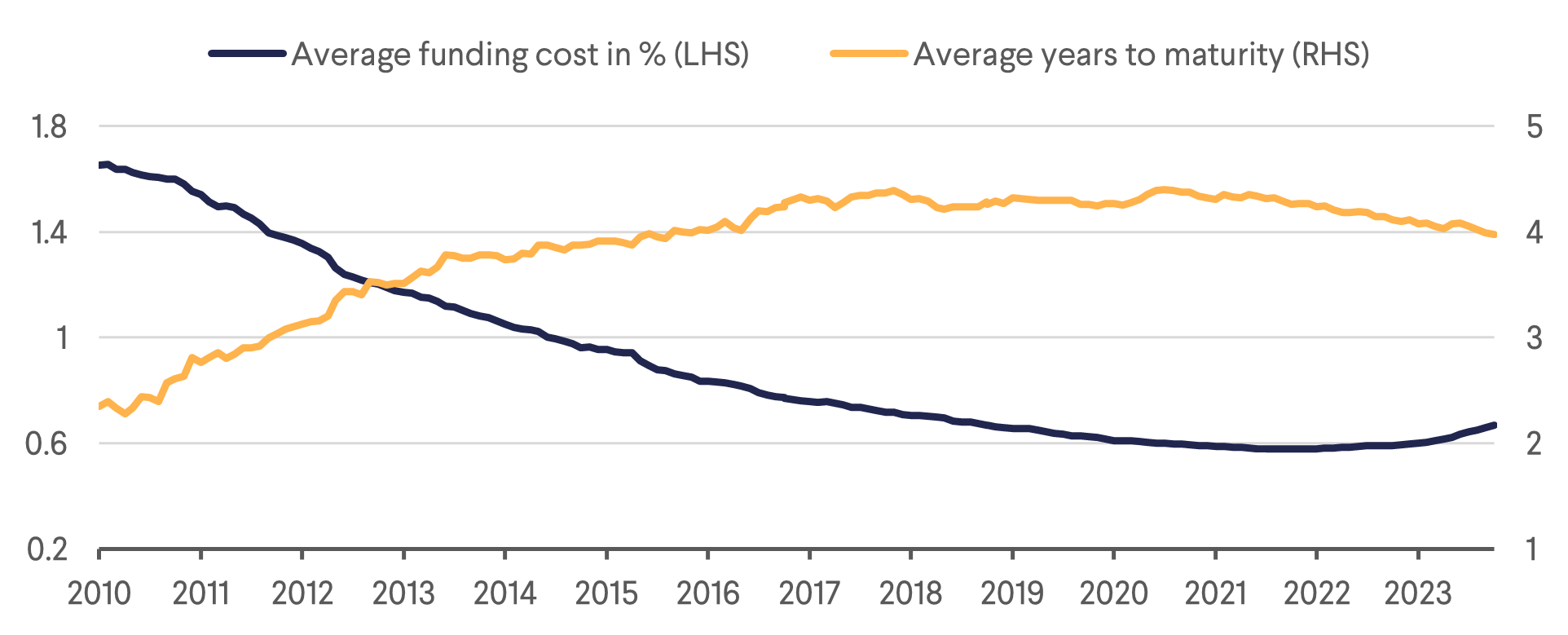

Increase in interest expense is gradual as the REITs have had mostly (>90%) long-dated (average maturity c.4yrs) fixed rate debt and are able to mitigate the rise in interest cost by refinancing into floating rate and/or shorter duration debt. Given the current real estate fundamentals, we expect the rise in market rents will outpace the increase in interest cost as BOJ’s hikes are expected to be modest.

We think that there had been an overhang on the J-REIT market mainly due to uncertainties in BOJ monetary policy and the possible impact on inflation from President Trump’s incoming policies. As we get more clarity on these macro factors in 2025, the final roadblock will be removed thus paving the way for the recovery of the J-REIT sector.

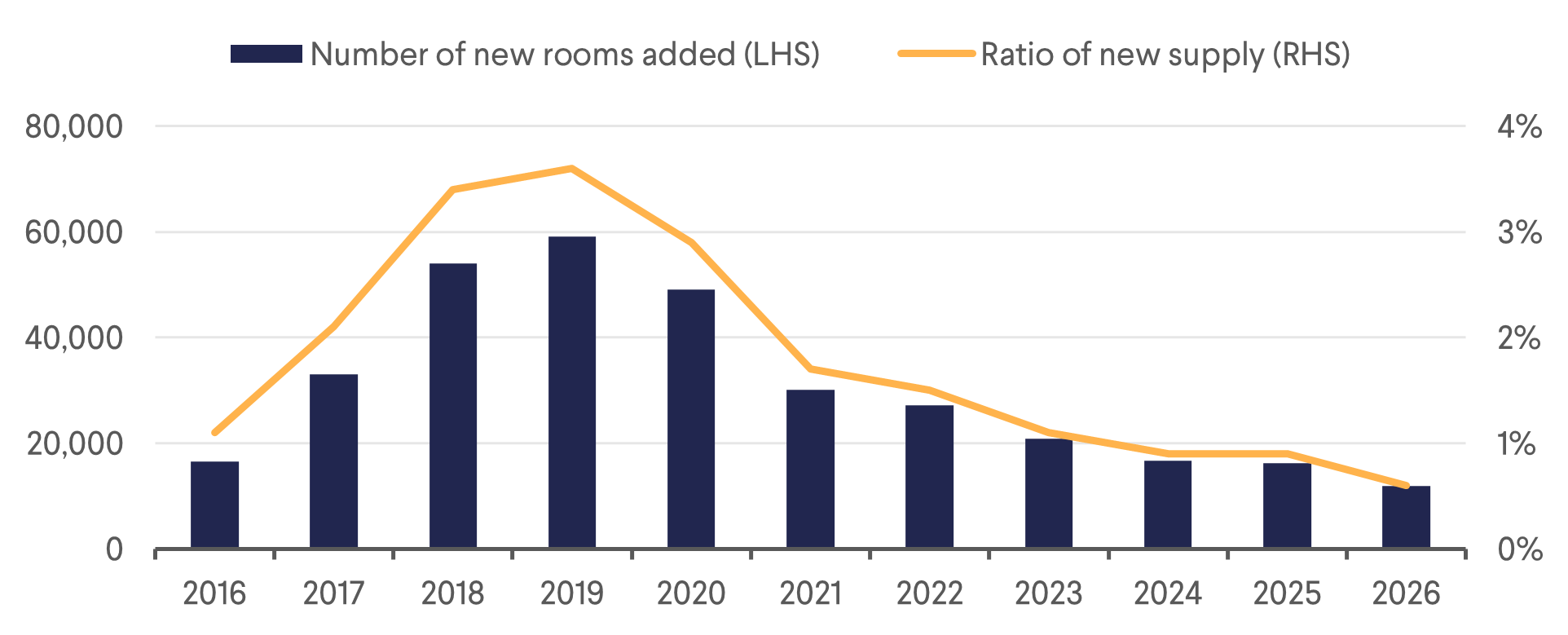

High Construction Costs Limiting New Supply

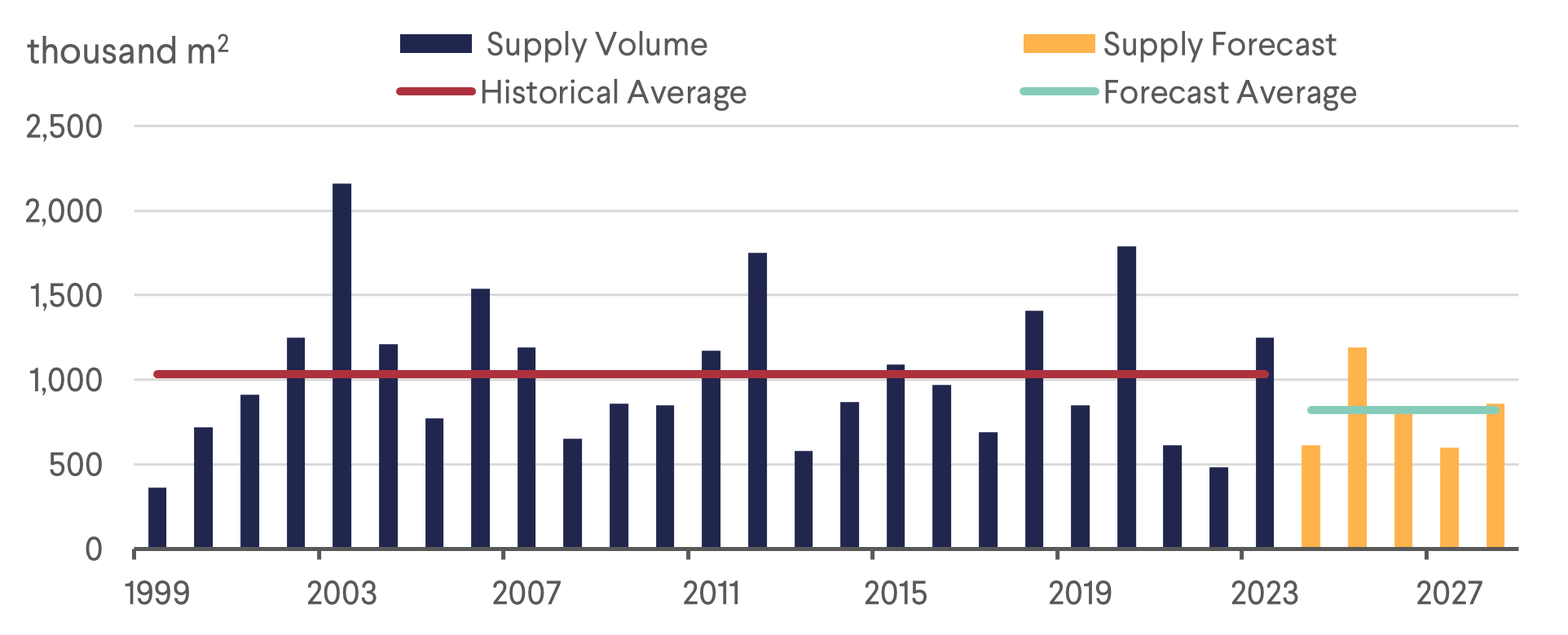

Construction costs have increased about 30% since 2020 due to higher material costs and labour shortages. In addition, contractors prefer datacentre or semiconductor related projects due to higher margins, exacerbating the labour shortage and increasing cost for the mainstream development projects. While material costs have somewhat stabilized, we expect the labour shortage issue to persist given Japan’s aging population and aversion to migrant workers. Labour cost is thus expected to continue to rise or at least remain elevated. Market rents have not risen at the same pace resulting in some projects being cancelled or delayed.

These factors have and will continue to limit new supply despite the rising market rents. Developers are more selective in their projects, gravitating toward those where higher costs can be passed on to buyers or tenants (e.g., condos, S-class office, hotels). Owners of existing buildings will also benefit from new supply entering the market at higher asking rents/prices. We believe market rents still need to rise significantly to justify meaningful new supply, and that is provided there is labour availability. Barring a recession, 2025 is playing out to be a landlord’s market with the demand/supply balance in their favour.

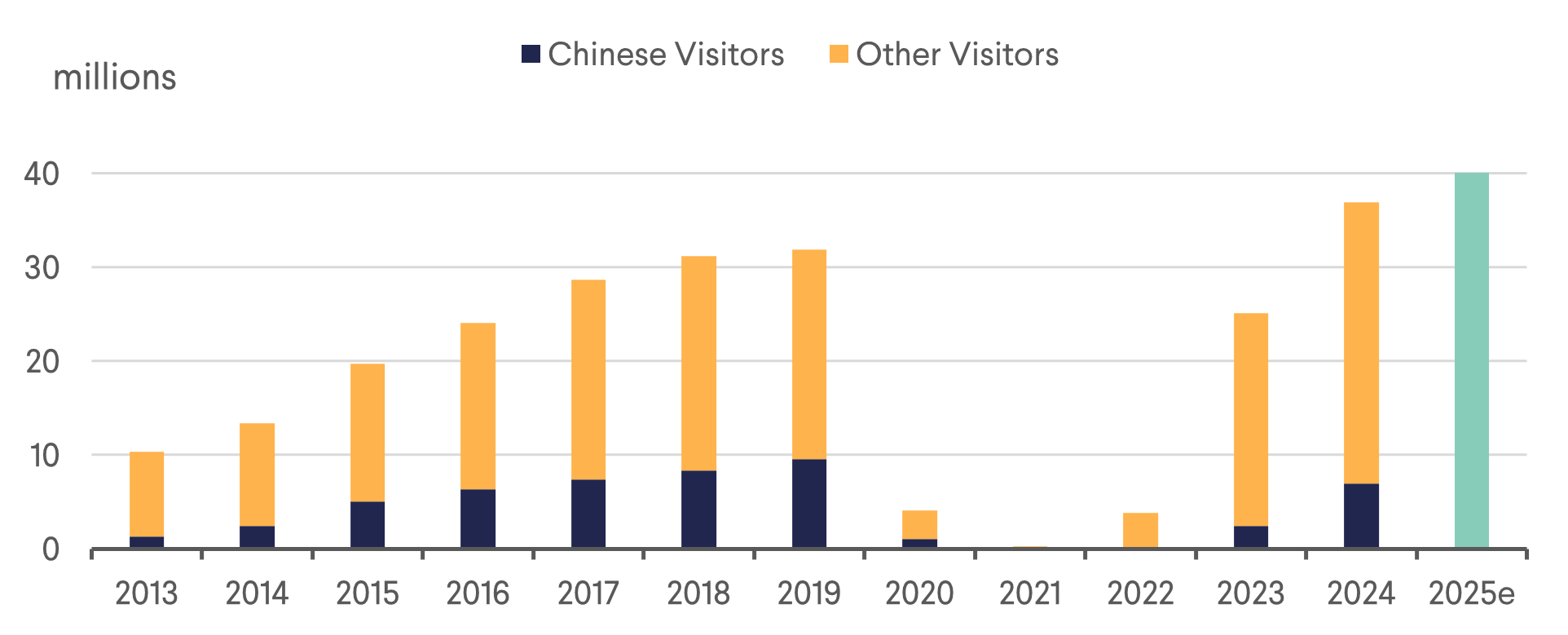

Tailwind for Hotels on Limited New Supply and Return of Chinese Inbound

Hotel REITs started selling off in May last year, likely on concerns that inbound arrivals will taper off with the strengthening yen, the waning effect of pent-up demand, and on complaints of overtourism from locals. While we have seen a rebound in 2H as the yen weakened and inbound arrivals continued its strong growth trajectory, we think there is still a long runway for the hotels rates.

Japan saw a record high 37m tourist arrivals in 2024 (+15.6% vs 2019), while spending a total of JPY 8.1tn, far surpassing the previous record of JPY 5.3tn in 2023. Japan Tourism Board (JTB) is expecting 40m visitors in 2025 and is targeting 60m by 2030. Osaka will be hosting the World Expo in 2025 and will later be home to Japan’s first casino resort slated to open in 2030. In addition, Chinese inbound in 2024 was just c.70% of 2019 and the visa relaxation measures just implemented in December 2024 will be a tailwind going into 2025. Despite expecting 10% increase in demand in 2025, new supply will be less than 1% of existing stock. New supply will still likely continue to be severely limited beyond 2025 by high construction costs and labour shortages, while demand is projected to increase by 60% over the next 6 years.

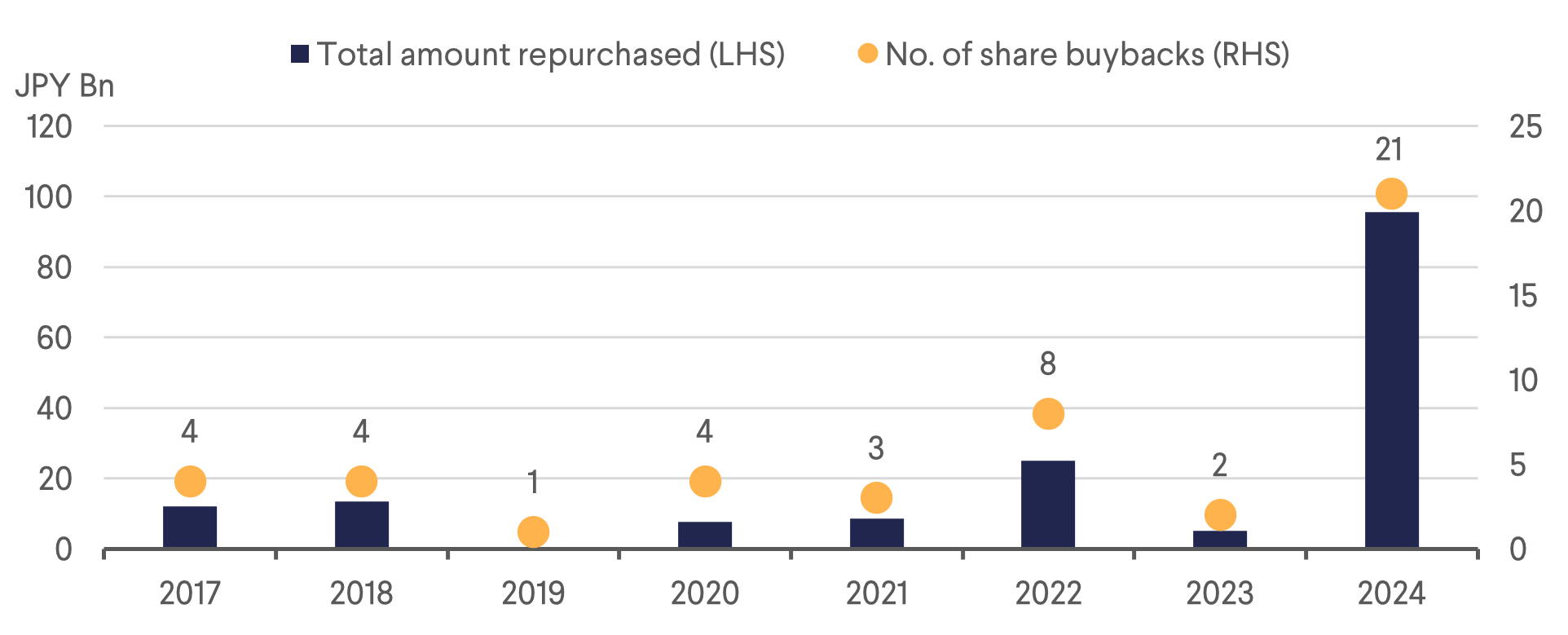

Activist Interest in JREITs and M&A

We have seen significant activist activity in the Japanese equity space in the past few years and it had resulted in an improvement in capital efficiency and corporate governance at Japanese companies. J-REITs pay out most of their accounting profits as dividends and have until recent years been mostly trading at or above their NAVs, and have thus largely escaped the crosshairs of the activists. With the REITs currently at a 20% discount, they are now catching the attention of some activist funds. Sell-side analysts are getting more enquiries on J-REITs from activist funds and some of them are starting to build up positions.

J-REITs are externally managed and have the bulk of their management fees linked to asset size; as such, in the past when the sector was trading at a premium, shareholder and management interests were aligned. The current situation, with REITs trading at a discount, presents a conflict of interest as managers are incentivized to grow assets even when it is detrimental to shareholders. While a small number of REITs have made changes to their fee structures to better align management and shareholder interests, we see significant room for improvement in this regard.

While we do not expect a takeover bid, the activists might push for the sale of a large chunk of assets and the use of proceeds for unit buybacks. J-REITs have already been selling assets and announced a record number of unit buybacks in 2024 (21 buybacks averaging 1.7% of shares outstanding). We are not investing based on this activist theme, but we do think the activists could help further improve corporate governance and pique interest in the sector, narrowing the NAV discount. M&A opportunities could also become a topic given the long tail of small-cap J-REITs that are unable to grow organically given the high cost of equity. We saw the merger of Mitsui Fudosan Logistics (3471) and Advance Logistics (3493) in 2024 and could see more this year if the REITs continue to trade at such a discount.

Download the PDF version of the report here