Overview

We were in Tokyo for the Mizuho Japan Alpha Conference from 2-6 September, where we had one-on-one meetings with Developers and J-REITs, and we also visited Fukuoka, Kumamoto and Osaka for property tours and meetings.

Meetings were generally upbeat with management migrating from a defensive stance of raising occupancy to a more offensive stance of raising rents. Newly completed prime office towers are signing record rents, mid-size office REITs are seeing vacancy stabilize and are able to get more tenants to agree to rent increases. Urban retail is seeing strong rent reversions as the weak yen both encourages inbound spending and continues to discourage locals from travelling overseas. The logistics sector is seeing rent growth above the rate of inflation and some REITs, such as GLP-JREIT (3281), have CPI-linked clauses in 80% of their leases. At the national level, tourism from mainland China has rebounded strongly, but still not back to pre-COVID levels. Our visits to hotels in Osaka and Fukuoka support this, as conversations indicated that Chinese inbound recovery is picking up but still has much room to grow. Despite the shortfall compared to pre-COVID, mainland Chinese visitors were still the largest visitor group to Japan over the past two months, highlighting the outsized importance of this group.

Kyushu island (where Fukuoka and Kumamoto are located) is also known as “Silicon Island”, the Silicon Valley equivalent of Japan. We met Kumamoto prefectural government officials who shared their perspectives on the strategic advantages of Kumamoto being the center of semiconductor manufacturing in Japan. Taiwan Semiconductor Manufacturing Company’s (TSMC) fabrication plant was completed in February and is expected to reach full production capacity by the end of the year. A second plant is expected to be completed in 2026, and a third plant is under consideration, though its location has not been determined (Sendai had come up as a possible candidate). TSMC’s plants are expected to bring about an economic impact of JPY 6.9tn (USD 50bn) to Kumamoto over 10 years. While we are unable to directly participate in this revival of semiconductor manufacturing through the listed real estate space, we think it bodes well for the Japanese economy in general and the impact will trickle through.

As the gateway city of Kyushu, Fukuoka (an hour away from Kumamoto by bullet train) is also expected to benefit from TSMC’s presence in Kumamoto. Fukuoka also has a number of positive attributes that contribute to its attractiveness. It is a popular tourist destination, especially with Koreans and Taiwanese. The relocation of its airport has also relaxed height restrictions in the Tenjin area leading to redevelopment there, also known as the “Tenjin Big Bang”. Furthermore, despite the new office developments, office vacancy remains low as Fukuoka is attractive to many technology companies with its relatively younger demographic. In Fukuoka, we visited Canal City (Fukuoka REIT, 8968) a retail mall popular with inbound tourists, as well as Grand Hyatt Fukuoka, which Hoshino Resorts REIT (3287) acquired from Fukuoka REIT in June at a very reasonable USD 150k/key.

We generally felt comfortable with our portfolio positions in Japan and did not make any major changes following the visit. As mentioned, the broad-based rent growth in Japan benefits the REITs as well as the domestic business of Developers, and as often is the case, the risk we see is in the developers’ overseas business. Nomura Real Estate still faces slow sales in their Vietnam condo business. Mitsubishi Estate (8802) and Mitsui Fudosan (8801) have factored in sales of overseas assets into earnings but we are unsure if the transactions will happen given the high cost of capital overseas. These risks are present but are mostly manageable and they can simply increase domestic sales to make up for any shortfall as they have done historically and typically with no issue.

Key Takeaways

Office Market Firmly in Recovery

According to data from Miki Shoji, Central Tokyo vacancy started falling in the 2nd half of last year after peaking out at about 6.5% but asking rents only turned positive on a MoM and YoY basis in February and May this year respectively. Vacancy is now 4.76% (falling below 5% for the first time since the pandemic) and asking rent rose 1.8% YoY in the recently released August data. Pre-leasing at the major office completions in 2025, a year of high supply, is progressing well and initial concerns of an oversupply are subsiding.

Mitsui Fudosan achieved record high office rents at their newly completed Tokyo Midtown Yaesu, even higher than that of Marunouchi on the other side of Tokyo Station, which has traditionally commanded the highest rents in Tokyo. Tokyu Fudosan’s (3289) Shibuya Sakura Stage completed in November last year is now 99% leased with rents higher than underwritten. Companies are facing labour shortages and are willing to pay high rents to have a convenient and modern office to attract and retain talent. Office vacancy rates at the major developers have all fallen to low single digits.

Likewise in the mid-size office space, focus has shifted from raising occupancy to hiking rents. Lack of supply and lower vacancy mean tenants are more willing to accept higher rents during renewal negotiations. Ichigo Office REIT (8975) actively renovates common areas in their assets or upgrades lighting in tenant premises to LEDs to coax tenants to agree to rent increases, often achieving double digit ROIs on their investment; this is a strategy we have also heard from other office managers. While we are not expecting strong rent growth in this segment, we believe demand for well-maintained mid-sized office in good locations will be resilient.

Where we might see some weakness is in the large floorplate office buildings that are aging and/or in weaker locations. We expect such office buildings to be negatively impacted by the secondary or tertiary vacancies resulting from tenants relocating to prime assets. For example, Kobe Steel recently announced they will be relocating their HQ from Mori TRUST REIT’s (8961) ON Building to Takanawa Gateway City to be completed next year. These large vacancies are typically more difficult to fill and see longer downtimes as opposed to the small floorplates at mid-sized offices.

We are bullish on prime office and have exposure through positions in developers like Mitsui Fudosan, Mitsubishi Estate and Tokyu Fudosan. While we think the mid-size office market is resilient, we are less enthusiastic about the rent growth prospects and have some exposure through diversified REITs KDX Realty (8972), Star Asia (3468) and XYMAX REIT (3488).

Corporate Governance Continues to Improve

Improving corporate governance remains a theme for both the developers and REITs.

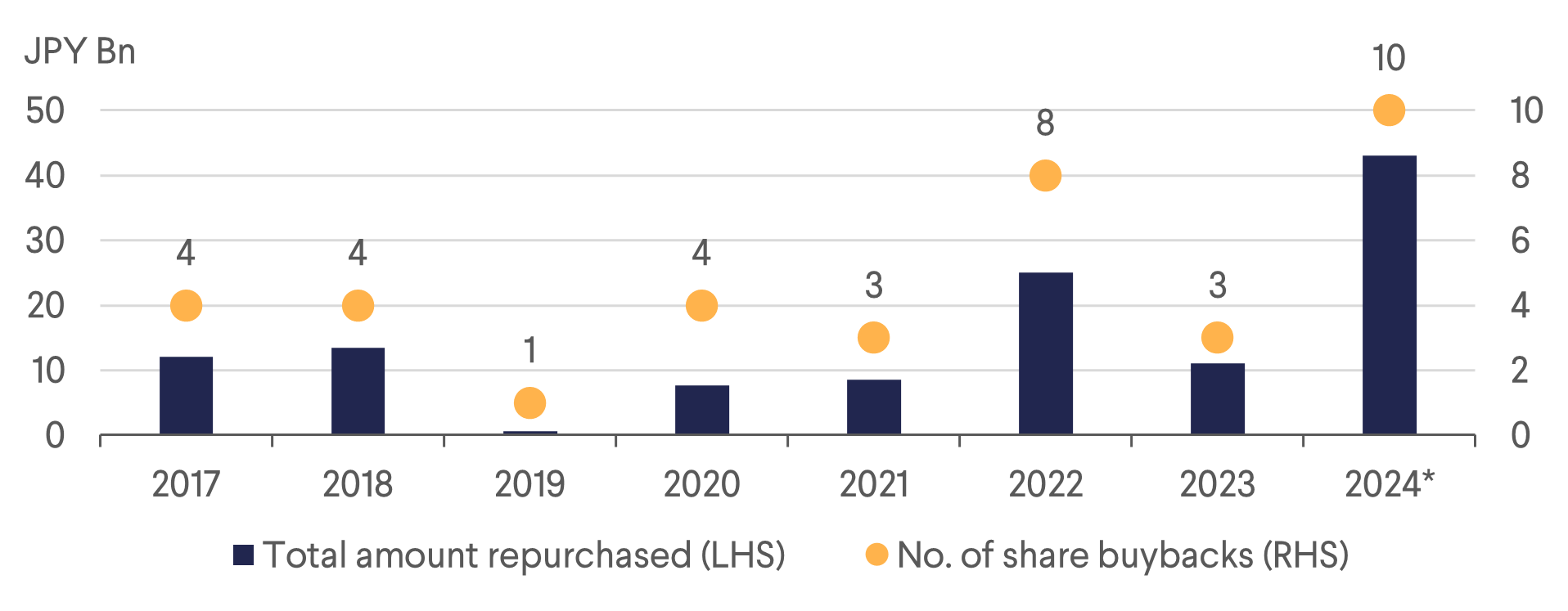

We were pleasantly surprised in our meeting with Mitsubishi Estate when they demonstrated a clear shift in shareholder return policy and capital allocation. In response to shareholder feedback regarding the inconsistency of their dividend and share buyback policies, they announced a dividend growth of JPY 3/unit per year to at least JPY 60/unit in 2030, and a share buyback of at least JPY 50bn every fiscal year until FY2026. As part of a larger commitment to recycle capital and improve ROE, they have decided to start selling less efficient properties in the prime office area of Marunouchi and Otemachi, starting with the partial sales of Otemon Tower and Otemachi Park.

Apart from buybacks by developers, REITs are also buying back their shares at record levels given the discount the sector is trading at. We think this is an effective use of capital as most REITs have an implied cap rate above the yields of properties they can acquire, and buying back their shares will result in higher accretion than asset acquisition.

Return of Chinese Inbound to Give Tourism Another Boost

The recovery of Chinese inbound since the pandemic had been slow relative to tourists from other countries. Chinese monthly inbound figures in July were still just below 75% of the same month in 2019, while comparatively total inbound is already 10% above pre-pandemic levels.1

We visited 2 hotels in Osaka, Star Asia REIT’s KOKO Hotel Shinsaibashi and Invincible’s (8963) ART Hotel Osaka Bay, and we were told by management at both hotels that by August of this year, Chinese tourists had overtaken other nationalities to become the largest for the first time since the pandemic. This trend is likely to play out in Tokyo and other major inbound destination cities and give a booster shot to the hospitality sector, especially the limited-service segment where labour shortage is less of an issue.

Beyond the short-term boost from Chinese inbound, there are also other drivers such as the World Expo in 2025, plans for a casino in Osaka, and the simple fact that Japan is still relatively undiscovered by Americans and Europeans. Generally, Western tourists not only spend more on an absolute basis vs. their Asian counterparts, but also spend differently with more emphasis on accommodation and experiences.

We expect this combination of shorter-term tailwinds and secular trends to benefit our holdings in Japan Hotel REIT (8985), Invincible and Star Asia.

1Source: Japan National Tourism Organization (https://statistics.jnto.go.jp/).

Condo Market Still Strong

Condo sales remain strong, fuelled by low supply and increased affordability from rising wages and the number of dual income households. Developers we spoke with affirmed that condo sales are brisk and margins are expected to be maintained, at least until 2026 as construction contracts have already been locked in and they were able to pass on the higher costs to buyers.

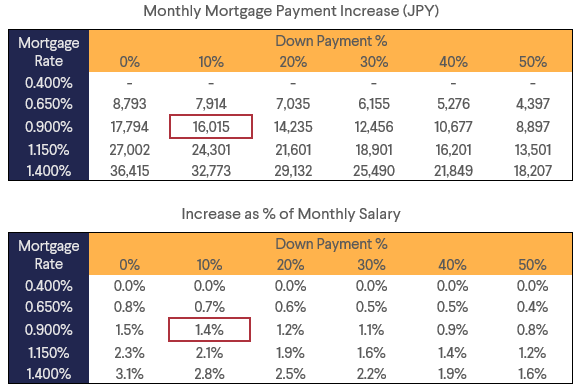

We did a sensitivity analysis of mortgage payments vs. base rates and found that the impact of an increase in interest rates on monthly payments as a percentage of income to be rather small. Assuming the typical condo buyer profile according to Nomura Real Estate (3231), dual income household with annual income of JPY 14mn buying a JPY 80mn condo with 10% downpayment on a 30yr floating rate loan (current interest rate c.0.4%), a 50bps increase in base rate will result in a JPY 16,015 (USD 114 @ USDJPY 140) or +1.4% increase in monthly payments. We think rising base rates will have limited impact on the demand of condos, and combined with the low supply, will give condo developers the pricing power to pass on the higher construction costs to buyers.

Logistics – Ready for an Inflationary Environment

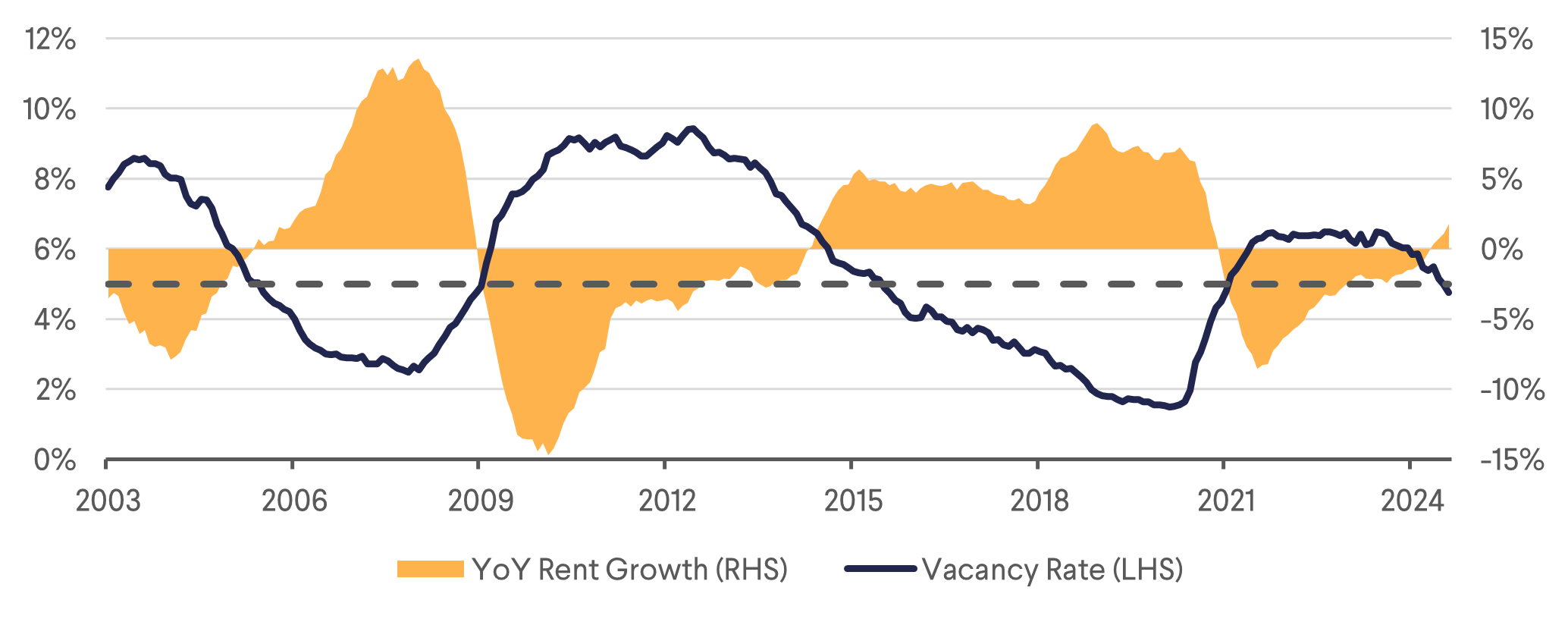

Logistics had been performing poorly relative to other sectors since inflation became a topic. Investors are likely worried about the rising vacancy rates and concerned that with the long duration of their leases, they will be unable to capture inflation like the residential REITs with shorter 2-year leases. With the discount the sector is trading at, and rent growth outpacing inflation, we think the concerns are unwarranted and current valuations make the sector very attractive.

While vacancy in Tokyo is currently around 8%, it is isolated to a few large developments and a long tail of small warehouses built by small developers that were late to the game and do not compete directly with the REIT’s properties. The properties owned by REITs are generally of higher quality, in better locations, and are mostly fully occupied. The shortage of labour and high cost of construction has squeezed out many of these small developers, and together with the difficulty in sourcing land, supply will be falling off quite significantly in the next few years. Higher development cost also bodes well for existing facilities as it raises market rents. CPI-linked clauses are also becoming more commonplace for long-term leases. GLP J-REIT has CPI-linked clauses in 80% of their leases which contributed an average 3.4% rent growth on top of reversions of +8.3% from lease renewals and tenant replacements.

In April of this year, a law came into effect limiting number of overtime hours for truck drivers. This has made operators more willing to pay higher rents for efficient facilities in good locations. Lasalle LOGIPORT gave us an example where a third-party logistics (3PL) company was able to save an equivalent of JPY 2000/tsubo (1 tsubo = 3.3 sqm) because the new facility allowed the drivers to make 5 trips a day instead of 2. GLP J-REIT’s sponsor has developed massive logistics hubs called ALFALINKs where tenants can reduce cost by trading with one another within the hub. Efficiency is further improved with trucking companies also having operations within the compound. ALFALINK Sagamihara (680k sqm) and ALFALINK Nagareyama (930k sqm) were almost fully leased at completion to more than 30 and 60 companies respectively.

Bank of Japan and the Impact of Higher Rates

Since the Bank of Japan (BoJ) raised interest rates at the end of July, the J-REITs have outperformed the TOPIX and the developers, and the TSEREIT Index is up 8.4% (as of 17th September, including dividends) in USD. Meanwhile the BoJ maintains a rather hawkish tone and economists generally expect a few more rate hikes by the BoJ before they settle at a rate ranging from 1%-1.5%.

While we are not macroeconomists and will not try to make predictions as to the BoJ’s rate hike plan, what we can say is that most REITs’ balance sheets remain strong, and while we will see some drag on earnings as maturing debt gets refinanced, this will be gradual as J-REITs have a weighted debt maturity of c.4yrs and a majority have 80-100% fixed rate debt. REITs have been refinancing at shorter durations of 3-5yrs from 7-10yrs previously and/or taking on some variable rate loans to reduce the impact of higher rates. Interestingly, since the BoJ raised rates, the 10yr JGB yields have come down to c.80bps from a peak of c.110bps and some REITs have started taking on longer duration fixed loans again.

The real estate transaction market remains active, lending support to property appraisal values. In fact, REITs are often able to sell properties above appraisal values and have been doing so to upgrade their portfolio or buy back shares with the proceeds and distributing capital gains as dividends. We also do not think a moderate increase in the base rate will negatively impact the condo transaction market as we have mentioned earlier.

Download the PDF version of the report here