Background

We attended the Nareit Conference in Las Vegas, where we toured REIT-owned gaming assets and the Summerlin master-planned community by Howard Hughes Holdings (HHH). In 34 meetings with real estate management teams, investor discussions often focused on the recent U.S. election and its implications for real estate. Many management teams maintained a positive outlook on the supply-demand dynamics in their markets. Persistently high construction and labor costs continue to limit new developments from meeting return thresholds, creating advantages for existing property owners. Before the conference, we toured office properties in Dallas and met with Highwoods Properties’ local development partner for market updates.

Las Vegas continues its transformation from a gambling hub into a diverse entertainment capital. The city has added professional hockey and football teams and plans to host Oakland’s pro baseball team within two years. It is also a premier conference destination, drawing market share from Los Angeles and San Francisco. Nareit was one of several organizations hosting events at the Wynn, and foot traffic in casinos remained strong, even on weekdays. The city grew busier as the week progressed, driven by the Adele concerts at Caesar’s Palace and the Formula 1 race, now a marquee event for Las Vegas casinos.

Big Picture Takeaways

What Does Trump 2.0 Mean for Real Estate?

In our meetings, management teams were repeatedly asked about the potential impact of a second Trump term on their businesses. Key takeaways include:

- Uncertainty persists: There is little clarity on Trump’s policy intentions versus political posturing.

- Mixed implications for REITs: Four primary issues—law and order, tariffs, immigration, and inflation/interest rate policy—pose both risks and opportunities.

Law & Order: Trump’s victory is seen by many as a pushback against progressive policies, with gains in even liberal urban areas suggesting a shift in sentiment. A move toward stricter law and order could benefit West Coast cities like San Francisco, Seattle, and Los Angeles. However, local election outcomes are often more influential; one management team cited a shift from progressive to moderate in San Francisco’s recent city supervisor elections, signaling potential improvement for challenged urban business environments.

Tariffs: Trump’s tariff plans could reignite inflation, with retail REITs most at risk. While headline inflation remains positive, goods are generally back to deflation in line with historical levels. A resurgence in goods inflation could weaken consumer demand, and pressure smaller retailers, increasing tenant turnover and challenging retail landlords.

Immigration: Most management teams expect Trump to tighten future immigration rather than pursue mass deportations. This could raise labor costs in sectors reliant on immigrant workers, such as nursing homes, hotels, and construction. For Skilled Nursing REITs like Omega Healthcare and Sabra, higher labor costs could hurt tenant profitability and rent coverage. On the upside, reduced immigrant labor may limit new construction across real estate, curbing supply and benefiting existing assets across REIT sectors.

Interest Rate Uncertainty: Despite two recent Fed rate cuts, the 10-year Treasury yield has risen from 3.7% to 4.4%, driven by uncertainty over whether Trump’s policies will fuel inflation. This rise has paused commercial and single-family housing transactions, which we explore further below.

New Supply Continues to be Limited – Long Term Tailwind

We anticipate lower supply growth across most real estate sectors in the coming years, which will steadily increase pricing power. The reason is straightforward: it’s currently significantly cheaper to buy existing assets than to build new ones.

For example, senior housing operating (SHOP) assets in non-core markets are trading at c. USD 300k/unit, compared to c. USD 800k/unit to develop new ones. Similarly, retail properties are priced around USD 300/sf, while new construction costs USD 450/sf. This dynamic is evident across sectors, with limited new supply except for Data Centers, where high rents support development costs but power constraints still restrict growth.

This trend is unlikely to reverse until one or more of the following occur:

- Rents rise significantly (a gradual process).

- Borrowing costs decline.

- Development costs fall, driven by lower material and labor expenses.

Rate Uncertainty = Transaction Uncertainty

At the Nareit conference in NYC last June, REIT management teams were optimistic about declining interest rates spurring transaction activity and M&A. This optimism seemed validated over the summer as several large Sunbelt apartment portfolios traded hands. However, sentiment in Las Vegas was more cautious, with many prudently preparing for a more uncertain rate environment. With the 10-year Treasury yield back at 4.4%, ambiguity over rate trajectories has paused transactions as investors await clarity on Trump 2.0 policies.

Higher rates are also affecting the single-family housing market. Standard 30-year mortgage rates above 7% have slowed home buying, hurting storage REITs, which profit from home transitions, but benefiting single-family rental (SFR) and apartment REITs, which are seeing record-low turnover. Home sales in 2023 and 2024 are at their lowest levels in nearly 30 years. While we expect a return to historical norms eventually, ongoing rate uncertainty has delayed the recovery in home transactions.

Sector Takeaways

Data Center and Telecom

Data Centers continue to experience robust growth, driven by strong demand and constrained supply. New construction is limited by power shortages, stemming from inadequate local generation capacity, insufficient high-voltage transmission lines, or disputes over who bears their high costs. Supply chain challenges for key equipment, like generators and electrical components, persist, with lead times stretching to three years. While most AI-related demand comes from hyperscalers, retail colocation (0-1 MW) remains strong, with bookings significantly up year-over-year and lease terms extending to five years, compared to the previous average of three years.

Tower REITs also have a positive long-term outlook, supported by surging data demand. According to the Cellular Telephone Industry Association (CTIA), U.S. wireless data usage exceeded 100 trillion megabytes in 2023, up 36% YoY and the largest absolute increase on record. This represents a strong secular tailwind. However, although U.S. telecom carrier activity has grown throughout 2024, it remains sluggish compared to past upgrade cycles (e.g., 3G, 4G). Investors are watching for an inflection point, with consensus expecting acceleration in 2H 2025. Tower REITs’ 2025 guidance in January will be a critical moment for the sector.

Storage

Storage REITs have faced headwinds this year due to record-low apartment turnover and a stagnant housing market. High mortgage rates have locked homeowners in place, reducing housing moves—the primary driver of self-storage demand. While typical seasonal patterns have been disrupted, long-term we are positive on the sector and expect a return to the mean as new storage supply stalls and home transactions recover once rate uncertainty eases.

Healthcare

Skilled nursing (SNF) and senior housing operating (SHOP) REIT management teams struck a confident tone in our meetings. SNF and SHOP are thriving, supported by strong demand from the rapidly growing 80+ age demographic and minimal new supply due to prohibitive development costs. These REITs also benefit from high operating leverage, which amplifies performance during periods of rising occupancy. Post-COVID, growing occupancy has driven mid- to high-teens NOI growth, resulting in impressive FFO/share and DPU/share gains.

SHOP REITs like Ventas and Welltower expect occupancy to rise from the mid-80% range to around 90% in the coming years. Both SHOP and SNF REITs are trading at NAV premiums and issuing equity to acquire assets at attractive spreads. Omega Healthcare, for instance, has invested over USD 900m YTD in SNF properties at a 10% yield—nearly 300 basis points above its cost of capital—marking one of the best investment periods in its history.

Office

Office REITs have performed well this year, benefiting from strong leasing, rent growth, and share price gains. Sellers holding out for 2021 pricing are starting to capitulate, as seen with Cousins Properties' recent acquisition of a lifestyle office asset in Charlotte and COPT Defense Properties' September purchase of a vacant San Antonio office, which they promptly leased to 100% with two tenants. Leasing and acquisition pipelines remain strong across the sector.

Residential

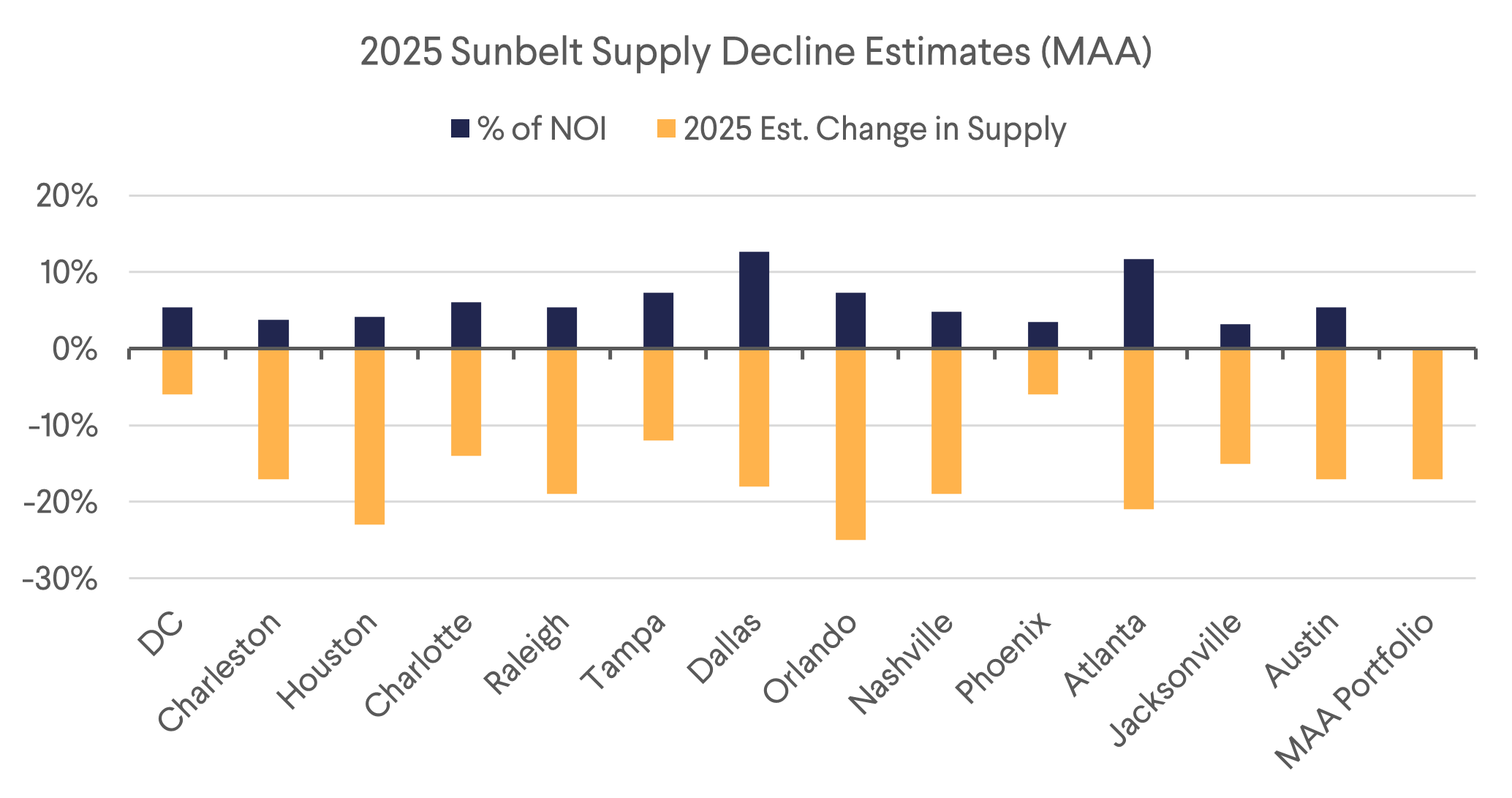

We remain bullish on Sunbelt apartments and expect a positive inflection in new lease growth in 2H 2025. While Coastal REITs may see higher absolute rent growth, we expect a more pronounced rate of change in rent growth in the Sunbelt, which has faced the most supply in the past 40 years. Camden Property Trust's management noted that supply will sharply decline in their Sunbelt markets in Q2/Q3 2025, coinciding with peak seasonal demand. This should drive positive new lease growth in the second half of the year. Mid-America Apartments, the largest Sunbelt owner, expects supply to fall -17% across their portfolio in 2025. If the job market remains strong, this will lead to restored pricing power.

Master Planned Communities

We attended Howard Hughes’ (HHH) Investor Day and community tour of Summerlin, where the virtuous cycle of Master Planned Community (MPC) development was on full display. Starting with a large tract of well-located land, MPC developers invest in infrastructure (water, power, roads, parks, fiber optics) to attract residential and commercial development. Residential lots are sold at a premium, driven by the increasing share of new home sales, which has more than doubled since 2010. A 100% increase in new housing starts since 2010 has eaten away at the supply of vacant homebuilder lots. The supply of Vacant Developed Lots (VDLs) in Summerlin sits at 11 month’s worth of supply vs. the equilibrium level considered to be 20 months, leading to a 10% CAGR in Summerlin land prices since the first lots were sold in 2011.

HHH supplements its land sales by developing and retaining ownership of retail and commercial properties, allowing them to control supply and avoid oversupply. The company sells condominiums in its markets but typically holds onto multifamily properties and is piloting single-family rentals in Bridgeland, TX. Across its MPC portfolio, HHH’s retail, office, and apartment units are 95-96% leased and boast the highest rents in their MSAs. Their condominiums also achieve the highest prices per sf. By maintaining community aesthetics with builder restrictions, HHH is replicating the success of its past MPCs like The Woodlands, with Summerlin’s 127k residents enjoying average household incomes double the Las Vegas MSA and median home values 75% higher. The MPC business model is predicated upon continual NAV accretion through the virtuous cycle of community development.

Gaming

We toured Caesars Palace with VICI Properties, a Gaming REIT, and were impressed by the bustling casino floor, restaurants, and event spaces. VICI highlighted how Caesars and other tenants, like MGM, benefit from Las Vegas evolving into a sports, entertainment, and culinary hub alongside gambling. Caesars Palace maintains strong demand with 99.9% occupancy and an average guest stay of 3.5 nights.

VICI has the liquidity and motivation to acquire more casino assets in 2025, though transactions can be large and infrequent. In the interim, VICI seek to grow its AFFO/share by 4% annually through opportunities like its Partnership Property Growth Fund, where it provided USD 700m in financing to Apollo for renovations at the Venetian Casino (which VICI owns), driving higher rent while improving the property. We expect VICI to expand this fund in 2025, potentially partnering with MGM Resorts to finance renovations at its older properties on the southern end of the Vegas Strip.

Asset Tour Pictures

Highwoods Properties Dallas Office Tour in Dallas, TX – 15 November 2024

|  |

Source: B&I Capital US Inc.

Howard Hughes Holdings Community Tour in Summerlin, NV – 18 November 2024

|  |

Source: Howard Hughes Holdings

VICI Tours of Caesars Palace in Las Vegas, NV – 18 November 2024

|  |

Source: B&I Capital US Inc.

Download the PDF version of the report here