Market Overview

Listed REITs have reached levels not seen since the 2007-2009 GFC. If the REIT index (-9.43% as of end of October, -1.89% as of writing, 21/11/23) ends the year in negative territory, it has only been negative for two consecutive years three times since 1972, never three years in a row.

Listed REITs have strong balance sheets, reduced leverage, and improved dividend payout ratios. Therefore, as the lagging private RE market starts to reflect spot valuations, this is enabling well capitalised listed REITs to selectively exploit private market distress, something we have seen various times in 2023.

While we refrain from offering specific advice, going into 2024 and assuming interest rates are peaking, which is traditionally the best time for REIT relative performance, an opportunity presents itself in listed REITs.

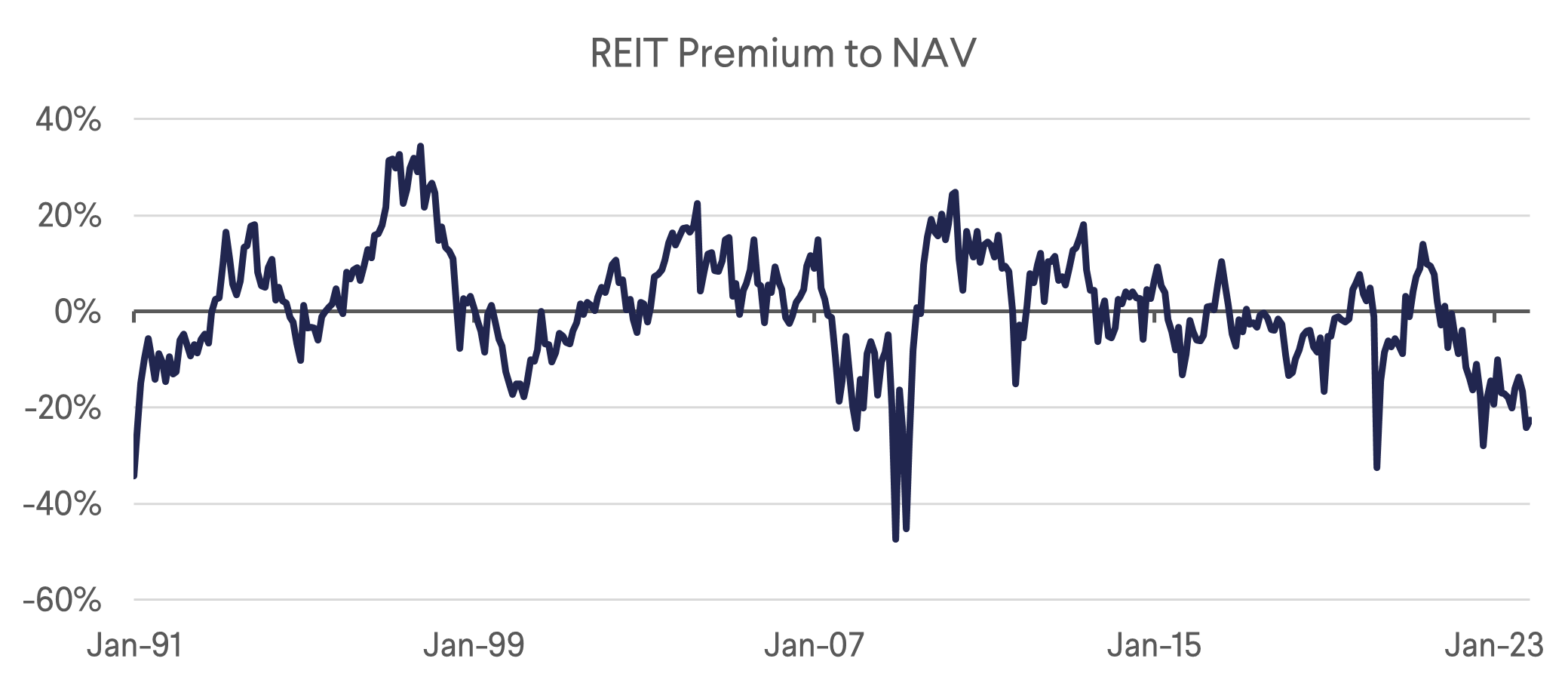

Source: Greenstreet REIT Premium to NAV 01.1990 – 10.2023

Key Takeaways from Nareit Meetings and Property Tours

REIT Dividend Yields vs Bond Yields

In October, the 10-year US Treasury rose to 4.88%, its highest level since 2007. The surge in Treasury yields, from 3.42% at the end of April, and increased borrowing costs, had made debt a relatively more attractive asset class vs. both equities and REITs as well as increasing borrowing costs for companies, pressuring share prices. While this surge in yields, alongside other factors like QT and the resumption of US student loan payments, tightens financial conditions significantly and increases recessionary risks, it will also bring inflation down rapidly.

With the economy looking to be slowing rapidly and inflation cooling, it is reasonable to assume interest rates have reached their zenith. If rates stabilize and even start dropping in 2024, as we believe, then REITs start to look attractive again relative to other investment opportunities, as REITs tend to outperform in the period when rates peak and then begin to fall.

The sharp moves we saw in the REIT market during the conference (FNERTR +4.48% vs SPX +2.31% on TR basis) were driven by a positive CPI report and falling bond yields that provided clues as to how we can expect REITs to perform in 2024.

The current spread between REITs’ dividend yields and the 10-year bond rate is flat. Factoring for REIT earnings growth, we calculate the positive spread to be c.250, still below the long-term average of c.380bps. For investors who believe interest rates will remain at this level, REITs do not appear so attractive on a yield gap basis. However, they do look attractive on a NAV basis; our global strategy is trading at a c.20% discount to NAV.

US Demographic Shifts

Millennials (born 1981-1996) are now the largest population cohort in the US with c.79m people. The youngest millennials are 27 while the oldest are 42. This generation is in its prime family formation and home buying age. Millennials are at the age where they want larger homes in proximity to better schools outside of city centers where they can start families. However, the lack of affordable starter homes in the US (median home prices at all-time high of USD 430k) has put home-ownership out of reach. As a result, many are turning to renting homes instead of owning them. We believe this secular demographic shift has and will continue to benefit single family rental (SFR) REITs such as American Homes (AMH) and Invitation Homes (IVNH) in the coming years.

Baby Boomers (1946-1964) make up the second largest cohort of Americans with c.72m people. As this generation ages, many will require assistance and medical care provided in senior housing and skilled nursing facilities. REITs such as WELL, the largest owner of senior housing units in the US, and Omega Healthcare (OHI), the largest pure-play skilled nursing REIT, stand to benefit from increasing senior demand which is known as the “silver tsunami”.

Supply Cycle – Peaks in 2H 2024

Most of our discussions with REIT management teams about supply/demand fundamentals followed a similar trajectory:

- Covid pulled forward demand for many sectors spanning from Life Sciences to Class A apartments which allowed REITs to raise rents above historic levels.

- Investors noticed this demand and raced to develop real estate with cheap debt.

- The Fed’s rapid rate hikes led to a tighter credit situation.

- More expensive debt caused business investment to slow.

- This in turn led to weaker demand for real estate.

- Weaker demand comes at a time when buildings started over the past years are finally being completed and delivered to market.

This situation has led to levels of supply which are limiting rental growth in a few sectors, most notably apartments, life science, and storage. For example, Alexandria Real Estate (ARE), a premier life science REIT, expects competitive supply to increase market inventory 6.1% in Boston and 8% in San Francisco in 2024, which is well ahead of historic levels. We met with Boston Properties (BXP) and ARE to discuss life science supply, and they told us they expect supply (which was financed and commenced in 2019-2021) to peak in 2024, halve in 2025, and fall off a cliff in 2026. Life Science developers are acting rationally and decreasing new starts in response to the supply imbalance the sector currently faces.

A similar situation is playing out in Apartments. UDR Inc (UDR) management team said new supply, which is most acute in Sunbelt markets, would hit hardest in 2024 and lead to flat NOI growth. Many of the apartments that are delivering now and within the next year were started during 2021-2022. This new supply will eventually be absorbed, and supply levels fall sharply in 2025 as nearly no developers are starting projects today.

Along with supply, increasing financing costs are dampening developers’ appetites to begin new projects. In the apartment sector, most construction loans are now SOFR +350bps, causing developers to debate taking development risk along with a 9% loan in the face of softening rent growth. This scenario is bound to lead to an abrupt decrease in construction and new supply in many real estate sectors in the coming years.

In storage, life science, and apartments we expect elevated supply and softer rents in 2024, an improved supply/demand picture in 2025, and a situation where undersupply could creep back into these markets and give REIT landlords strong pricing power in 2H 2025 and 2026.

Developers have halted new projects in 2023 due to oversupply in some sectors, but across real estate higher financing costs and rising construction costs make it unprofitable to start new projects in most product types. For instance, despite surging demand, senior housing REIT Welltower (WELL) made it clear in our meeting that they see very little threat from new supply. They attributed this to increased debt costs and persistently high labour and material construction costs. WELL’s CIO told us that rents would have to rise another 30-40% before developers could hope to underwrite senior housing projects with any shot at profitability.

While supply is a near-term threat to many REITs in 2024, the lack of new construction in 2023 will lead to the inevitable next phase of the real estate supply cycle in the coming years, when sectors are undersupplied at a time of increasing demand.

Frozen Capital Markets

Besides Data Center, SFR, and Senior Housing REITs, most REITs are trading at significant discounts to NAV. Prudent management teams are heeding this signal from the public markets and have avoided dilutive equity issuances.

Credit availability is also slowing. Banks are tightening lending standards due to macro uncertainty and interest rates have increased an unprecedented c.525bps since March 2022, sharply increasing interest costs. In response, REITs are using swaps to mitigate floating rate exposure; and have reduced the amount of leverage they are using overall.

To bridge the gap as they wait for the capital markets to thaw, most REITs are turning to one of three options. (1) Hitting pause on external growth (2) turning to joint ventures with institutional partners to fund developments or acquisitions or (3) using opportunistic dispositions to prune their portfolios of older/non-core assets and using the proceeds to fund external growth or pay down their most expensive debt.

Higher funding costs have created a dearth of transactions across real estate in the private and public markets. For instance, Essex Property Trust (ESS), a West Coast apartment REIT, told us that there were no meaningful apartment transactions in Los Angeles in 2023. This situation is being replayed across the country as sellers (anchored to 2022 prices) and buyers (now with higher debt costs) hold their breath to see who will adjust their price expectations first.

While REITs’ access to capital is more constrained than it was 18 months ago, lending spreads that REITs pay for loans are still tight, indicating that REITs remain credits of choice for banks, especially over private real estate creditors. We informally spoke with corporate bankers at the conference there to meet with their clients, the REITs, and they confirmed this situation.

Sector Takeaways

Data Center (DC) and Telecom (Overweight)

DC management teams are focused on driving efficiency, as measured by Power Usage Effectiveness (PUE). By improving the efficiency of their cooling infrastructure, etc., DCs with better PUE can lease out more capacity without obtaining additional power from the local utility, a major constraint in many markets. While Artificial Intelligence demand is picking up, we note that this type of demand is still limited to North American markets. Globally, DC demand is broadly healthy, with the industry leasing a record 1400 megawatts (MW) in Q3.

The Digital Realty (DLR) management team also fielded many questions about a joint venture (JV) with Realty Income (O), announced during the conference. This will be the first of many JVs for DLR on their quest to reduce leverage. Although O will take an 80% stake in this JV, DLR management expects future JVs to be around 50/50.

Office & Television (TV) Studios (Neutral)

The theme of “flight to quality” within the office sector remains, with trophy and Class A assets exhibiting significant leasing strength relative to older and Class B assets. Additionally, many Office REITs are now remarking on a “flight to strength” or “flight to stability” in the form of potential tenants underwriting landlords’ abilities to fund tenant improvements (TIs).

Hudson Pacific Properties (HPP), a California-focused office & studio REIT catering to the tech and media industries, gave a presentation on their studio business (20% NOI) in a private screening room at one of their office buildings that is 100% leased to Netflix. The mood was enthusiastic, as news of the actors’ strike ending was still being digested, and Netflix CFO Spencer Neumann was in attendance to confirm that the company plans to spend its usual USD 17bn on content next year, despite a likely six-month ramp for Hollywood to get back to full production. Media tailwinds remain strong, and HPP continues to improve margins by integrating studio services with sound stage ownership.

HPP management, taken with a pinch of salt, were talking down WFH, saying RTO is leading to an average push by tenants to four days/week in the office, up from the current three days. They also claimed WFH is ‘over’ judging by the increased velocity of deals.

Interestingly, it looks like San Francisco, where the conference was held last year, may be turning a corner while other west coast cities, led by LA, are still suffering from poor politics and management.

Healthcare (Overweight)

We had the opportunity to meet with senior housing REITs Ventas (VTR) and Welltower (WELL). Senior housing has been one of the best performing sectors this year as the sector’s occupancy steadily recovers from Covid lows. Senior housing REITs have high fixed costs and operating leverage, so when occupancy falls below breakeven levels, profits are hit hard, but on the flip side when occupancy accelerates, these REITs achieve outsized gains. VTR and WELL cited an aging population, accelerating occupancy, decelerating labor expenses, and data driven platforms that have expanded operating margins (WELL +330bps YoY in Q3) as reasons the sector had outperformed 2023. Both management teams indicated that these drivers along with below average supply growth will lead to a multi-year growth recovery story in the space - we agree.

Residential – Apartment (Underweight)

Apartment REITs’ Q3 results were disappointing and our NAREIT meetings reflected this. Increasing supply (more so in Sunbelt than coastal markets), difficult 2022 comps, and slowing job growth have led to decelerating blended rental growth in most markets. Rent in Sunbelt markets declined 3% YoY in October as REITs dropped rates to contend with developers offering up to two months of free rent as they try to stabilize new properties in saturated markets.

Coastal REITs with less supply, such as ESS’s suburban west coast markets, will likely fare better in 2024, but growth in the sector will likely be anemic after seeing rent growth in the high teens and even low 20% range in some markets in 2021-2022. Apartment share prices reflect the current reality at c.20% discount to NAV, but we remain cautious on the sector until we can see signs that either peak supply is being absorbed or job growth is accelerating. We expect the sector to return to eventually return to its long-term NOI growth run rate of 3%.

Asset Tour Pictures

Los Angeles REIT Apartment Tours – 13 November 2023

|  |

|  |

Hudson Pacific Properties (HPP) Office and Studio Tour – 16 November 2023

|  |

|  |

Rexford Industrial (REXR) Asset Tour – 13 November 2023

|  |

|  |

Download the PDF version of the report here