Market Overview

The JREITs had struggled in 2023 despite resilient fundamentals, while the developers have had a solid year with tailwind from rising inflation. The TSEREIT Index is -4.3% (-0.6% total return) whereas the TSERL Index which includes developers is +21.3% (24.4% total return) in 2023 (as of 8 December 2023).

While it is the consensus that the BOJ will abolish yield curve control (YCC) as well as normalise the negative interest rate policy (NIRP), the uncertainty around the timing and magnitude of the increase in policy rate creates an overhang for the JREITs. The 10yr JGB yields have come down from a peak of 98bps on 1 Nov to 73bps (as of 8 December 2023), but the TSEREIT was unable to sustain a rally and was essentially flat over the same period.

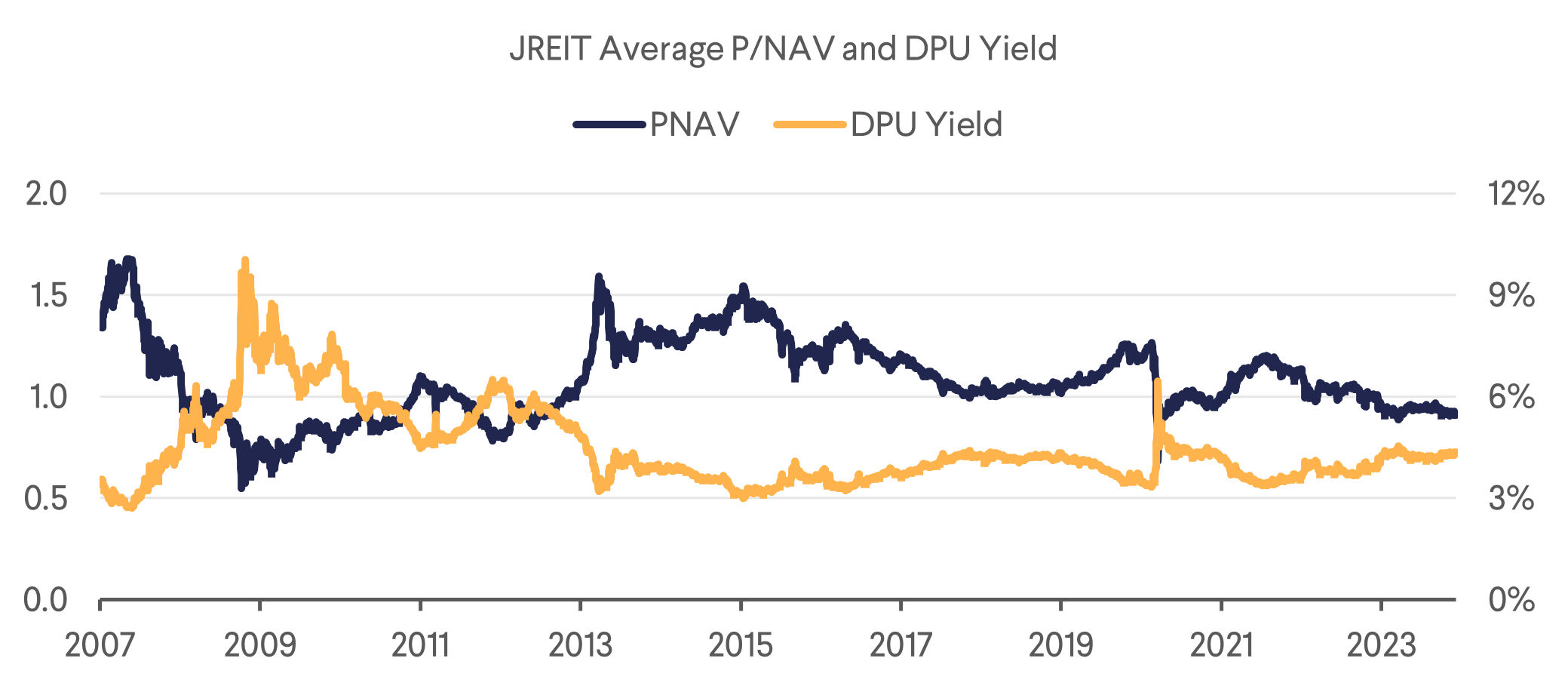

JREIT valuations are at the lowest level since the pandemic with the average P/NAV at 0.9x and an average DPU yield of 4.3%.

Source: SMBC Nikko

Key Takeaways from Conference

Business Environment

Based on the conversations with various REITs, the business environment in Japan appears to be improving. Office move-ins/move-outs are often due to expansion needs, urban retail stores are seeing strong sales and tenants are agreeing to higher rents, hotels are more profitable raising ADRs while voluntarily capping occupancy. JREIT management is typically conservative, preferring to under-promise and over-deliver. This is the most bullish we have seen management since the pandemic.

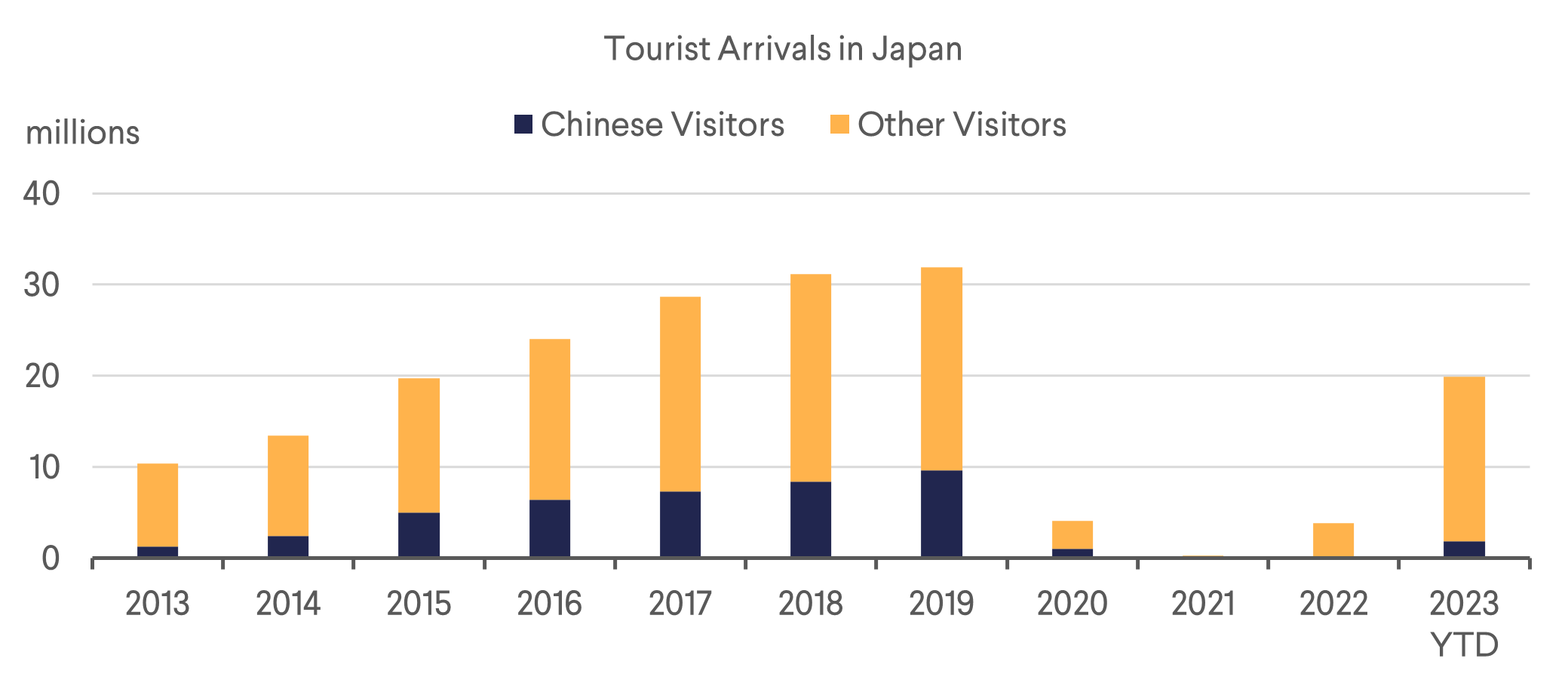

On the ground, areas like Shinjuku, Shibuya and Ginza are busy with locals as well as tourists, mainly from the US, Europe and Southeast Asia. While the recovery of Chinese tourists has been slow, tourists from other regions have made up for the shortfall and tourist arrivals in October has exceeded 2019 levels for the first time since the pandemic.

Shibuya Crossing at 4pm on a Friday

Shinjuku area at 10pm on a Friday

Credit Environment

While the base rates have increased, it has come down from the peak back in February this year and spreads have remained constant. The lending stance from the banks has generally not changed and credit is readily available for the REITs and developers under our coverage. While there was a period just after the pandemic when hotel REITs were not able to secure long-term financing, they are now able to refinance with longer duration loans (>3yrs). JREITs generally have healthy balance sheets with long duration (average 4yrs to maturity) and a high fixed rate ratio (typically >80%).

It is widely expected that the Bank of Japan (BOJ) will abolish the Yield Curve Control and the Negative Interest Rate Policy (NIRP) at either their monetary policy meeting in December or early next year. With current 10-year JGB yields at c.70bps, 30bps below the “reference rate” of 100bps, the cessation of YCC is likely not going to have a large impact.

As for the NIRP, consensus is that the BOJ is likely to be conservative and move to a zero-interest rate policy rather than a positive one. What this might affect is condominium sales as most mortgages in Japan are floating rate and this could affect buyer appetite. Developers we have spoken to believe that the rate increase is relatively small and is unlikely to dampen demand significantly. Prices are also expected to continue rising given the low supply and the tailwind from the greater affordability resulting from the rising proportion of dual-income households.

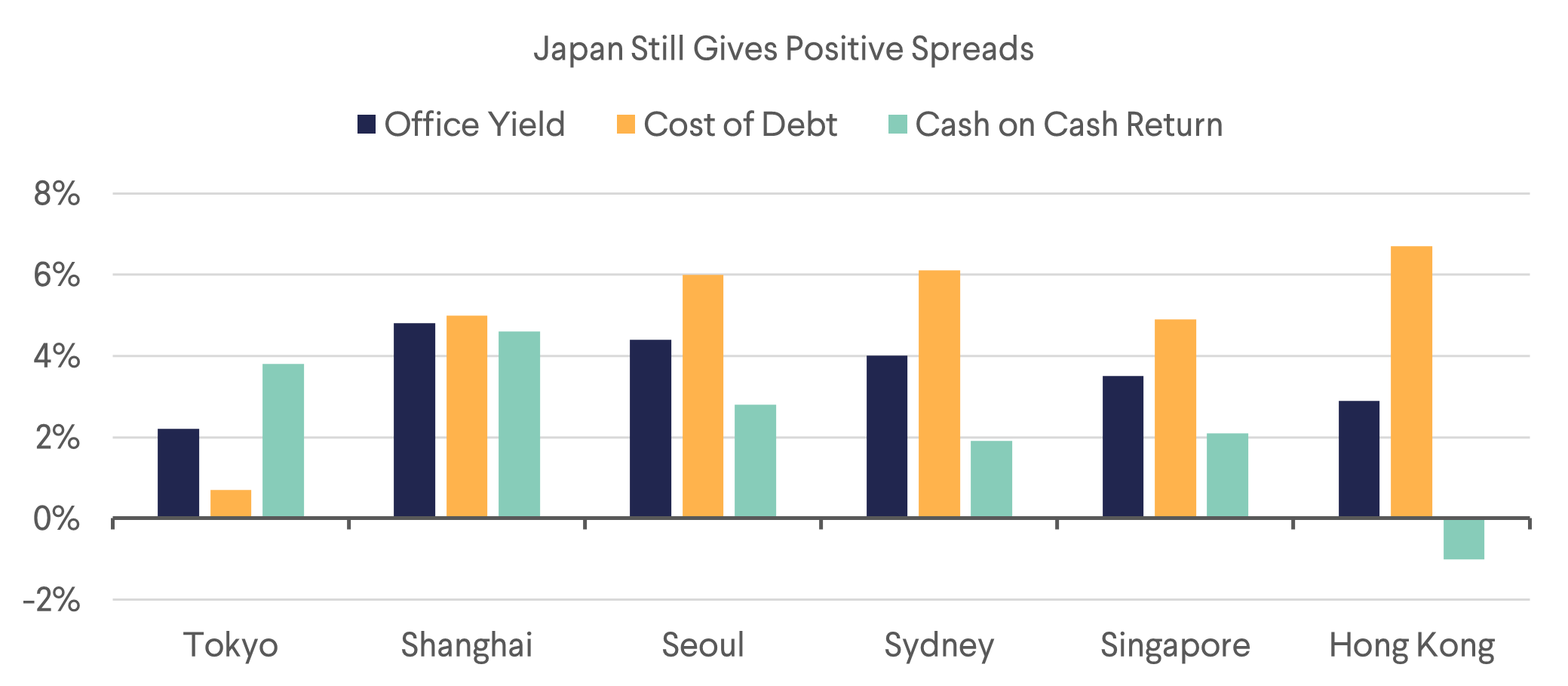

Transaction Markets

The property transaction market in Japan is still healthy given the weak yen and positive carry. As discussed in the previous section, interest rate moves by the BOJ are expected to be moderate and unlikely to reverse the positive carry.

Source: JLL (As of Q3 2023. Office yields are based on market yield; debt costs are based on 3-month floating rates and 50% leverage.)

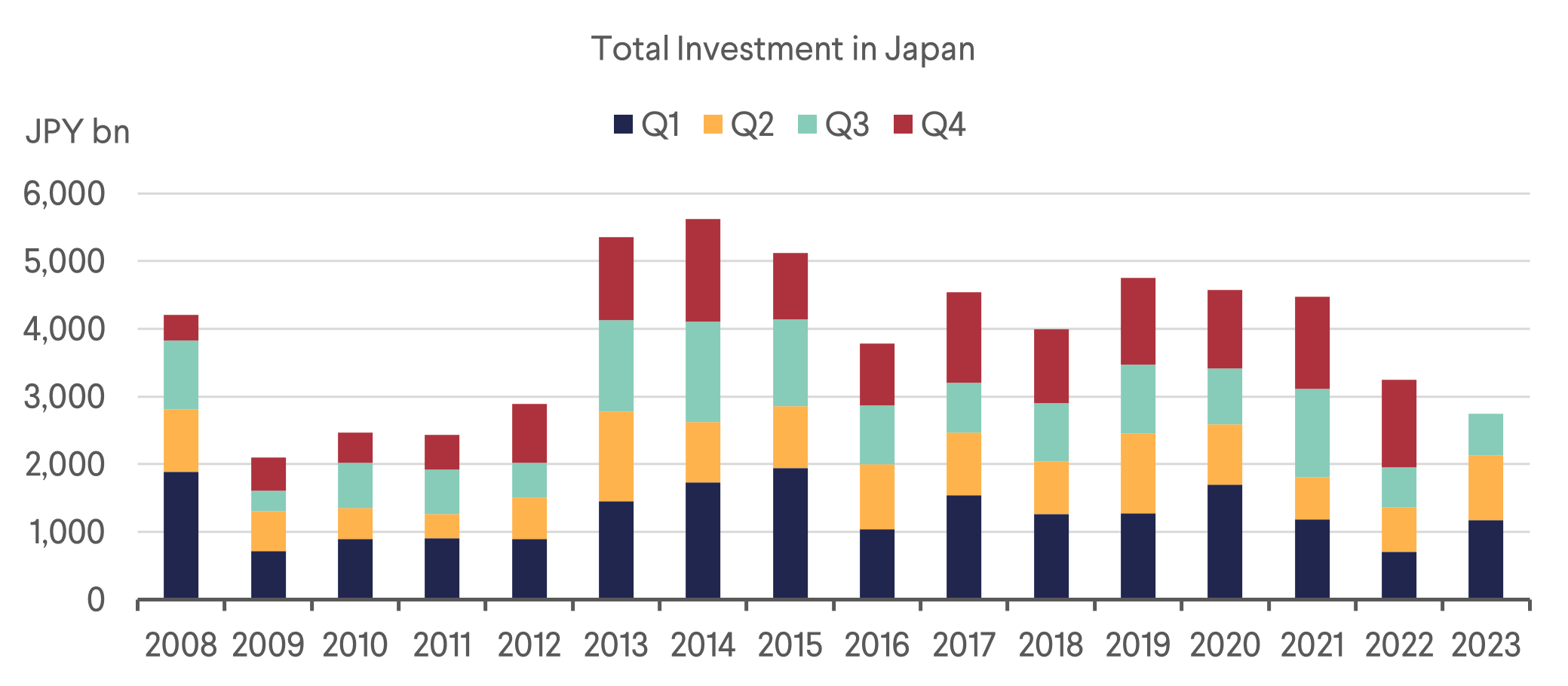

Transaction volume has picked up from 2022 with the focus shifting to logistics and hotel properties resulting in the share of transactions in the central wards of Tokyo to fall.

Source: JLL, SMBC Nikko

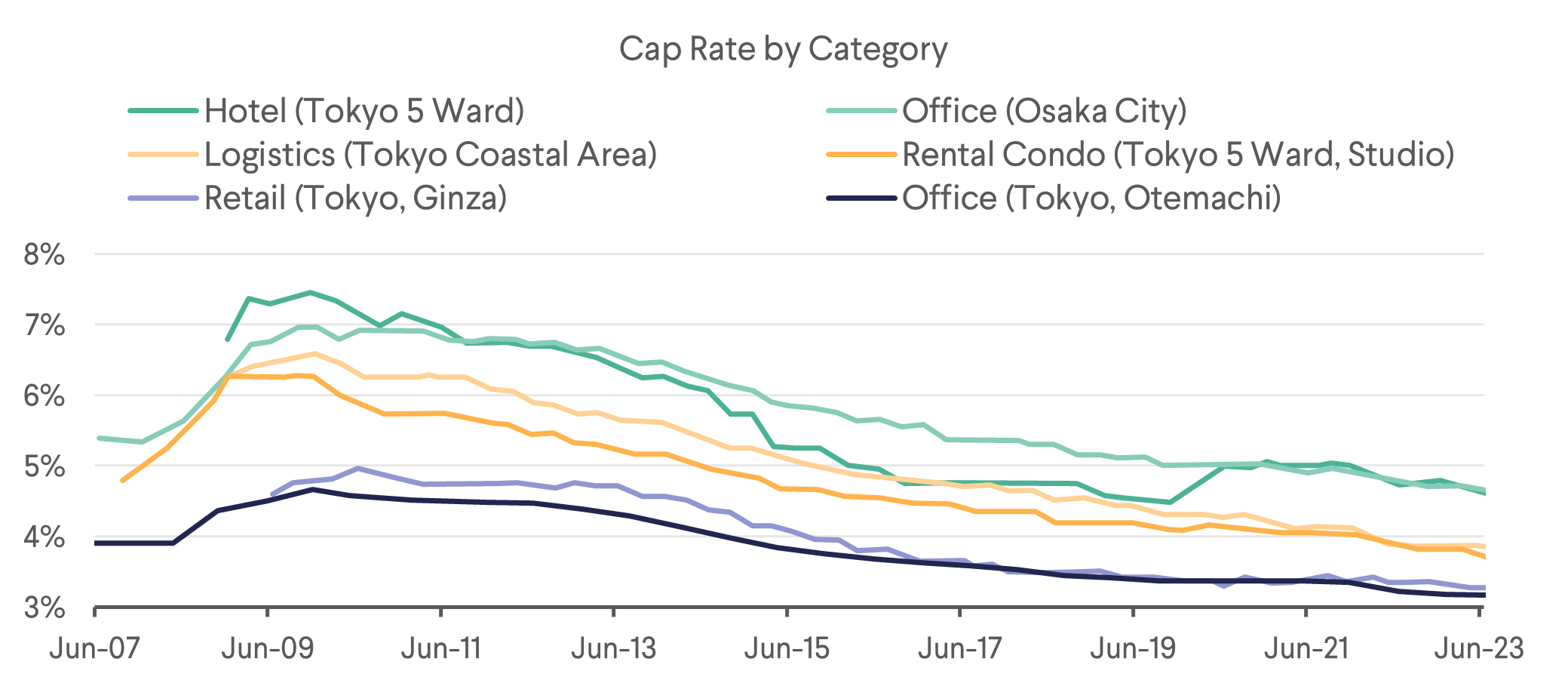

Cap rates have continued to compress and are at the lowest levels since the GFC. Hotel cap rates expanded during the pandemic but have since compressed back to pre-pandemic levels. REITs are generally trading at significantly higher implied cap rates representing a discount to the private markets.

Source: SMBC Nikko, CBRE

Improving Corporate Governance

There has been a recent renewed interest in Japanese equities by investors globally. While the low interest rate environment relative to other developed economies and Warren Buffet’s investments in the Japanese trading houses were key contributors, the improving corporate governance landscape is also often cited as a pull factor.

We had noticed the push for better corporate governance in the real estate sector (particularly the developers) long before the recent piqued interest. Many developers have announced medium or long-term plans that set targets for higher ROE (return on equity), EPU (earnings per unit) and total shareholder return ratio (TSHR). Some actions they have taken include selling off non-core businesses and/or cross shareholdings, increasing dividends, as well as conducting share buybacks.

Sector Takeaways

Office

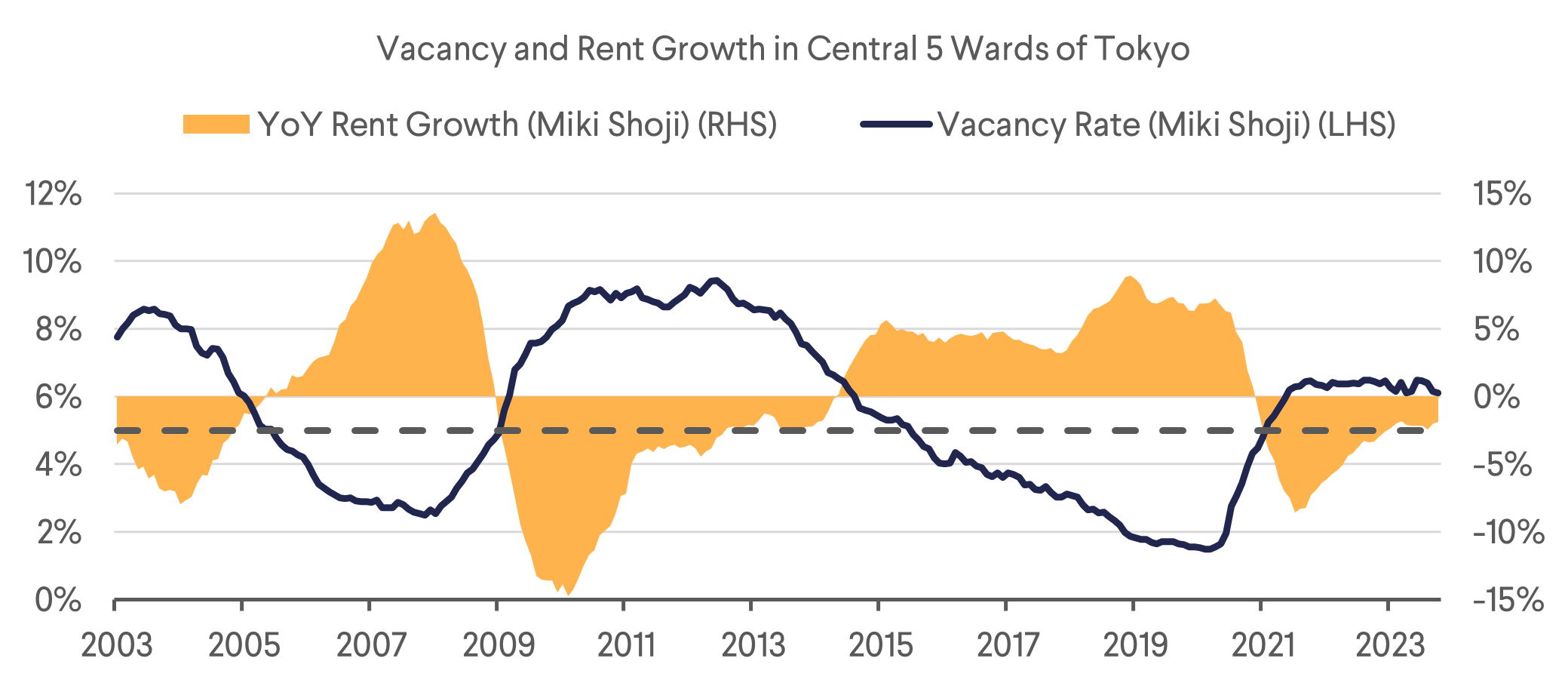

The overall office market appears to be bottoming out with both vacancy and rents stabilizing according to Miki Shoji. Physical occupancy is higher than the United States and Europe as apartments are generally small in Tokyo and not conducive for working from home, and “face-time” is valued in Asian culture. Some companies that reduced space during the pandemic due to teleworking have reversed their decision and are looking to expand again. That said, not all offices are built equal. Two segments of the office market are expected to perform well – New, modern, well-located S-class office buildings, and well-located mid-size office buildings.

Source: Miki Shoji

Newly built, modern offices next to train stations are in high demand. With the labour shortage situation in Japan, companies are trying to use new trendy offices to attract talent. Mitsui’s Fudosan’s Tokyo Midtown Yaesu project to the East of Tokyo station, which was completed in August, was fully pre-leased by March and at the “highest rent in Japan”, even higher than that of Marunouchi and Otemachi (the traditional CBD on the east side of Tokyo station). Tokyu Fudosan’s Shibuya Sakura Stage next to Shibuya Station is 95% leased at its completion at the end of November. Shibuya has become the IT center of Tokyo, being home to companies such as CyberAgent, Mixi, Snowflake and GMO, just to name a few. Google took up the entire Shibuya Stream building for its Tokyo office.

|  |

Tokyo Midtown Yaesu (left) by Mitsui Fudosan and Shibuya Sakura Stage by Tokyu Fudosan (right)

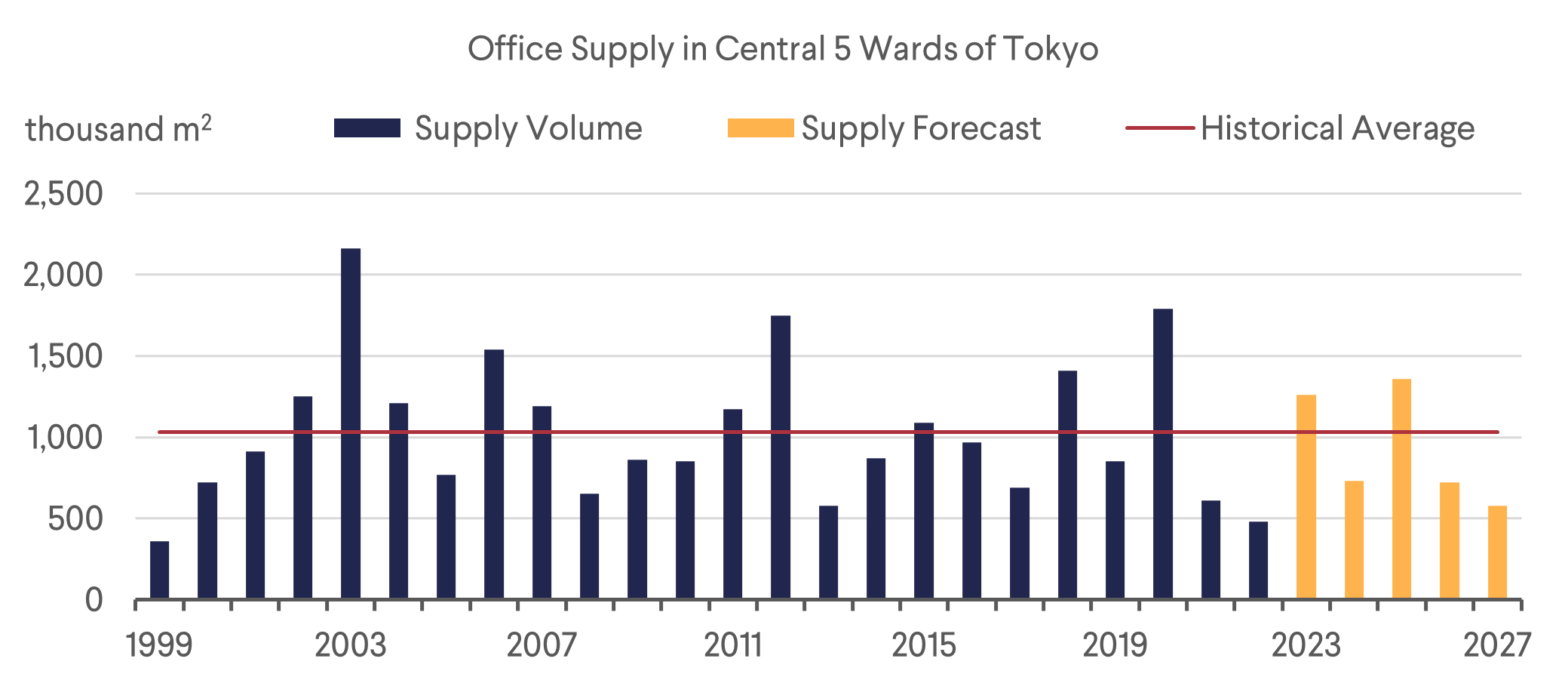

2023 is a year of large supply (1.26m sqft) and apart from the major projects listed above, most of it is concentrated in Toranomon Hills Station Tower and the massive Azabudai Hills in Minato Ward, both developed by Mori Building (unlisted) are at occupancy of 70% and 50% respectively. Both Toranomon and Azabudai are not traditional office areas but are undergoing gentrification led by large developments of Mori Building. Supply falls off in 2024 before picking up again in 2025.

Source: Mori Building

|  |

Azabudai Hills project (left) with its office tower on the left and residential tower on the right. Toranomon Hills Station Tower (right). Both developed by Mori Building.

The mid-size office situation appears to be turning around. Mid-size office REITs have been on the defensive since the pandemic, often lowering rents and/or increasing incentives to keep occupancy up. XYMAX REIT (3488), whose sponsor is one of the largest property management companies, is now saying that tenants are beginning to proactively approach them for lease renewals and are also more receptive to negotiations for rent increases. Rental reversions for mid-size office at XYMAX REIT and Star Asia (3468) have both turned positive. Supply in the mid-size office space is limited as rising land and construction costs mean that asking rents will have to be north of JPY 30k/tsubo (3.3 sqm) for new developments to be greenlit. Mid-size office REIT’s average rent is typically in the range of JPY 15k-20k/tsubo.

Vacancy in Osaka has fallen to 4.17% in November from the pandemic peak of 5.11%, and average asking rents have been relatively stable throughout the pandemic due to limited supply.

Retail

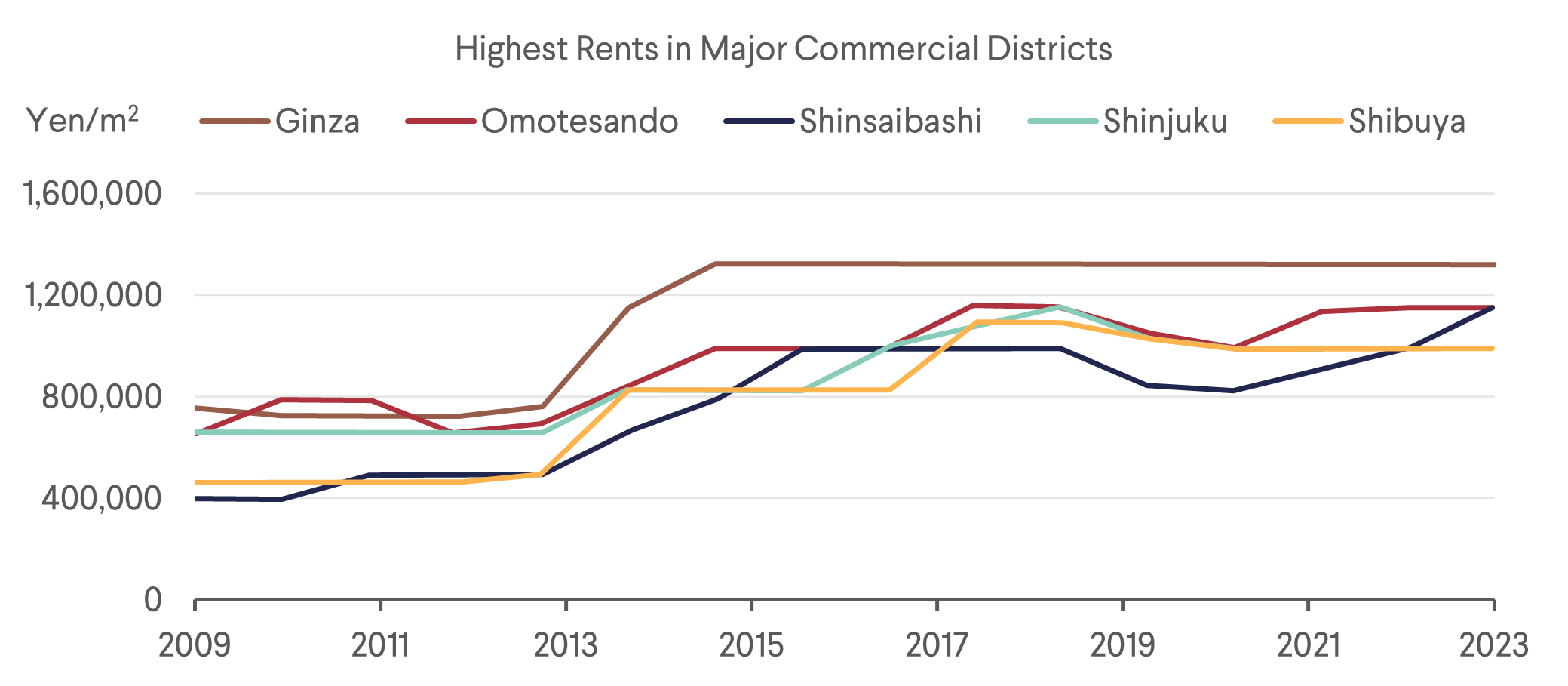

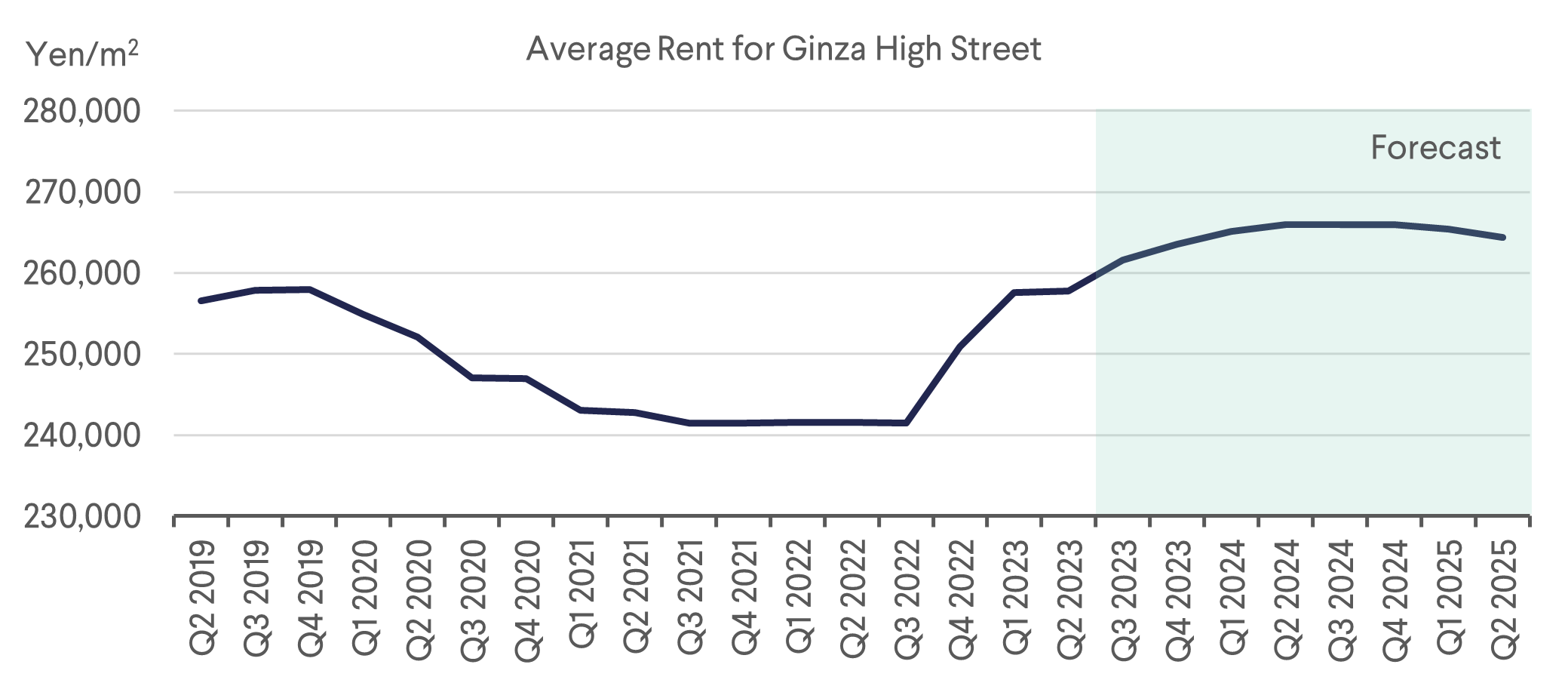

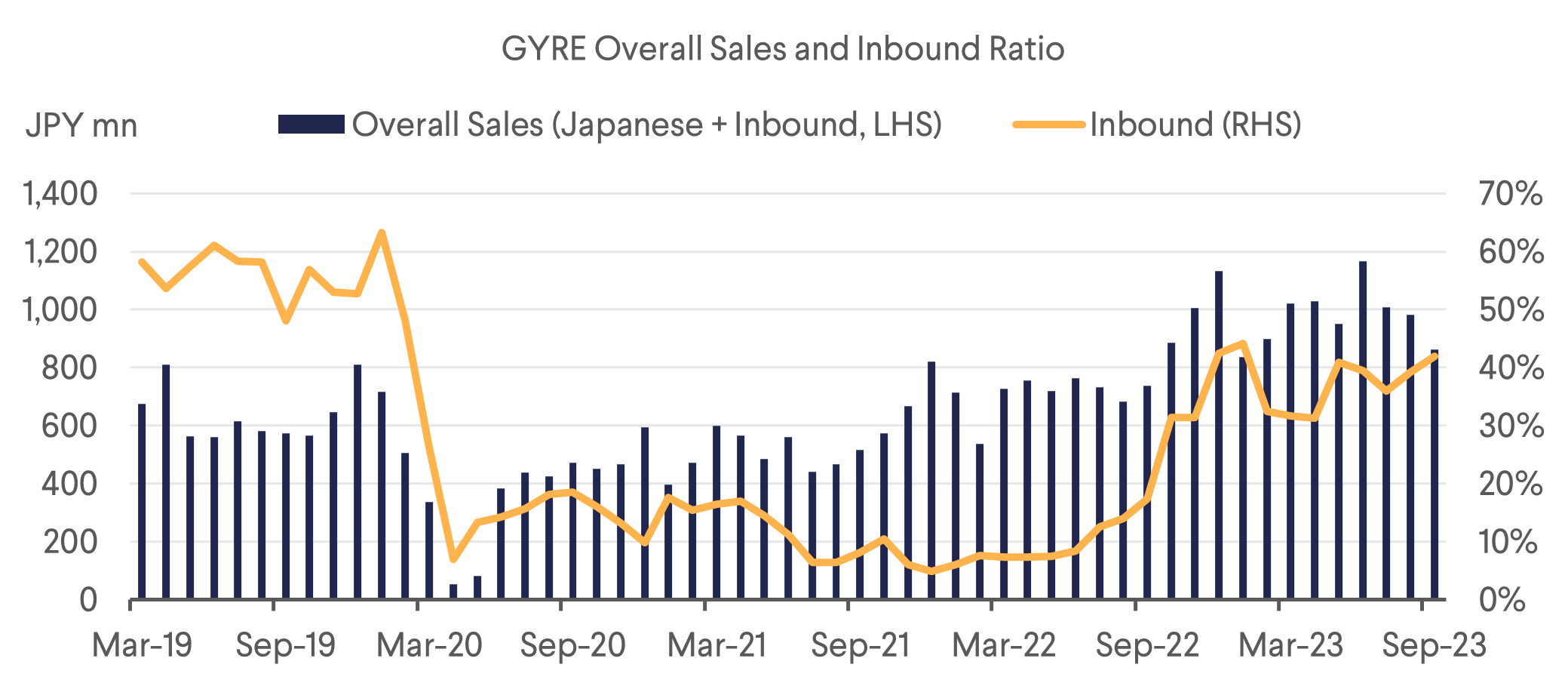

Urban retail in Tokyo has been on a steady path of recovery in terms of tenant sales and asking rent, which are both often above pre-pandemic levels. Recovery in Osaka is at a slower rate due to its high exposure to Chinese inbound pre-pandemic.

Japan Metropolitan Fund (8953) has been successful in raising rents in their urban retail property in Omotesando (GYRE, +16%) and in Shinsaibashi (G-Bldg. Shinsaibashi 01, +33%). They also managed to backfill vacancy in another property in Shinsaibashi signing Uniqlo as a tenant.

Source: JMF, CBRE

Source: JMF, CBRE (Average of upper and lower end of high street rents in Ginza)

Source: JMF

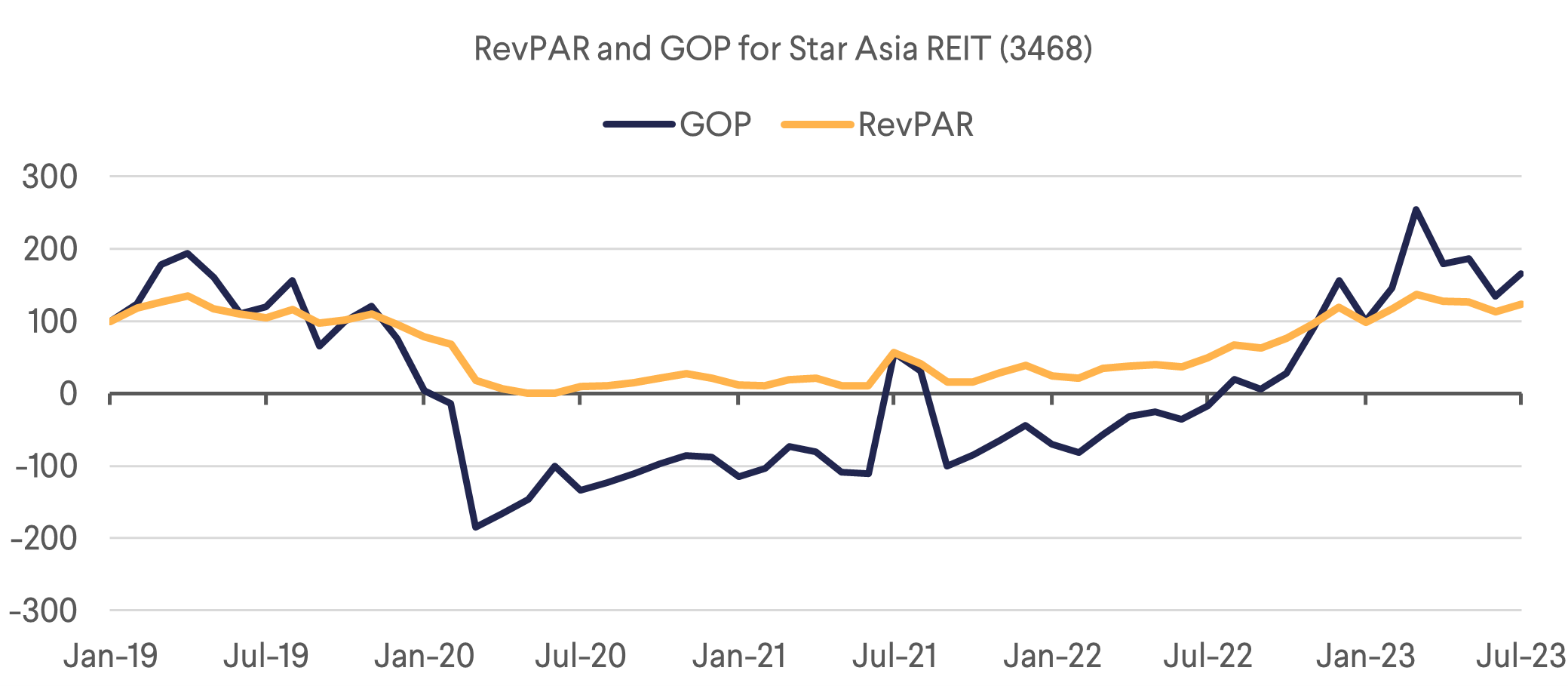

Hotel

The hotel industry is trending well with ADRs generally above pre-pandemic levels. During the early stages of the recovery, operators were faced with labour shortages (especially for full-service hotels) and had to limit occupancy. A positive side effect of that was that they were able to increase ADR and improve profitability. Currently, even with the labour situation improving, some operators have decided to continue limiting occupancy to prioritize profitability. According to Mori Trust REIT (8961), which has a few high end hotels in their portfolio, hotel operators have realized that the target occupancy in Japan before the pandemic had been too high and together with rising wage costs, they find the current lower occupancy level optimal. Hotels with GOP-linked variable rents will stand to benefit from the increased profitability.

Source: Star Asia Investment Corporation

Tourist arrivals have been steadily increasing with the reopening of the borders and buoyed by the weak yen. October arrivals exceeded that of the same month in 2019 for the first time since the start of the pandemic. Furthermore, this has been achieved even with Chinese inbound at 35% in October 2019. Recovery of Chinese inbound had been slower than expected due to the issues with their domestic economy and elevated geopolitical tensions. Tourist arrivals from other countries however are expected to make up for the shortfall of Chinese inbound. According to a survey by the Japan Tourism Agency, tourist spending in 3Q23 (Y1.39tn) already exceeded that of the same period in 2019 (Y1.18tn) with spending from Northeast Asia (Korea, Taiwan, Hong Kong) and long-haul markets making up for the Chinese shortfall.

Source: JNTO (As of October 2023)

Invincible (8963) and Japan Hotel REIT (8985) have both reported October RevPAR about 11% above 2019 and Invincible has further projected November RevPAR to be 14% above 2019.

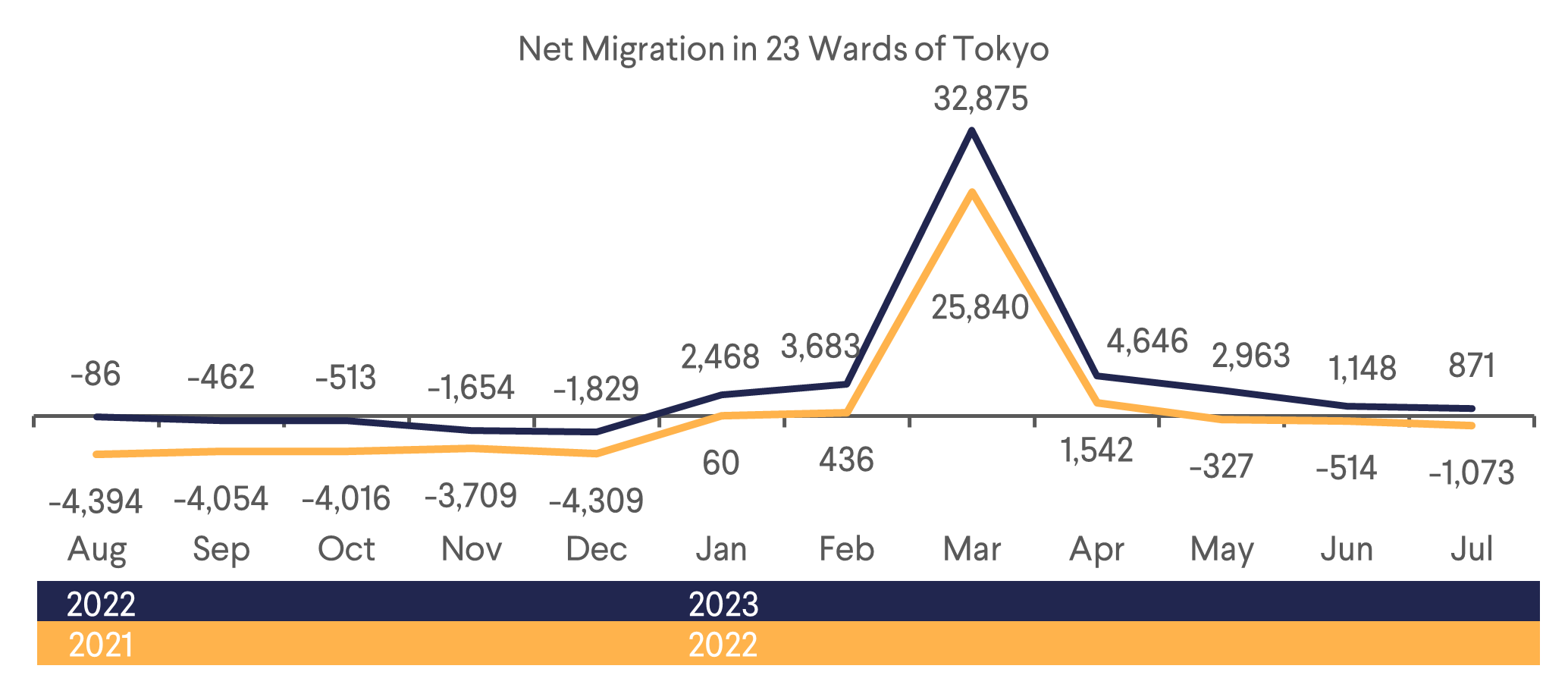

Residential

Tokyo saw a significant increase in net migration in 2023 and as a result, the single/compact type units that have been weak since the pandemic have started to turn around. Occupancy has been on an uptrend and rental reversions have also turned positive. Large/family type units continue to do well achieving the highest rent growth supported by the increased spending power from the rising number of dual-income households and favourable demand/supply dynamics. Residential REITs have generally pivoted from a defensive stance of focusing on raising occupancy to pursue rent growth again.

Source: Ministry of Internal Affairs & Communications, TLC REIT Mgmt. Inc

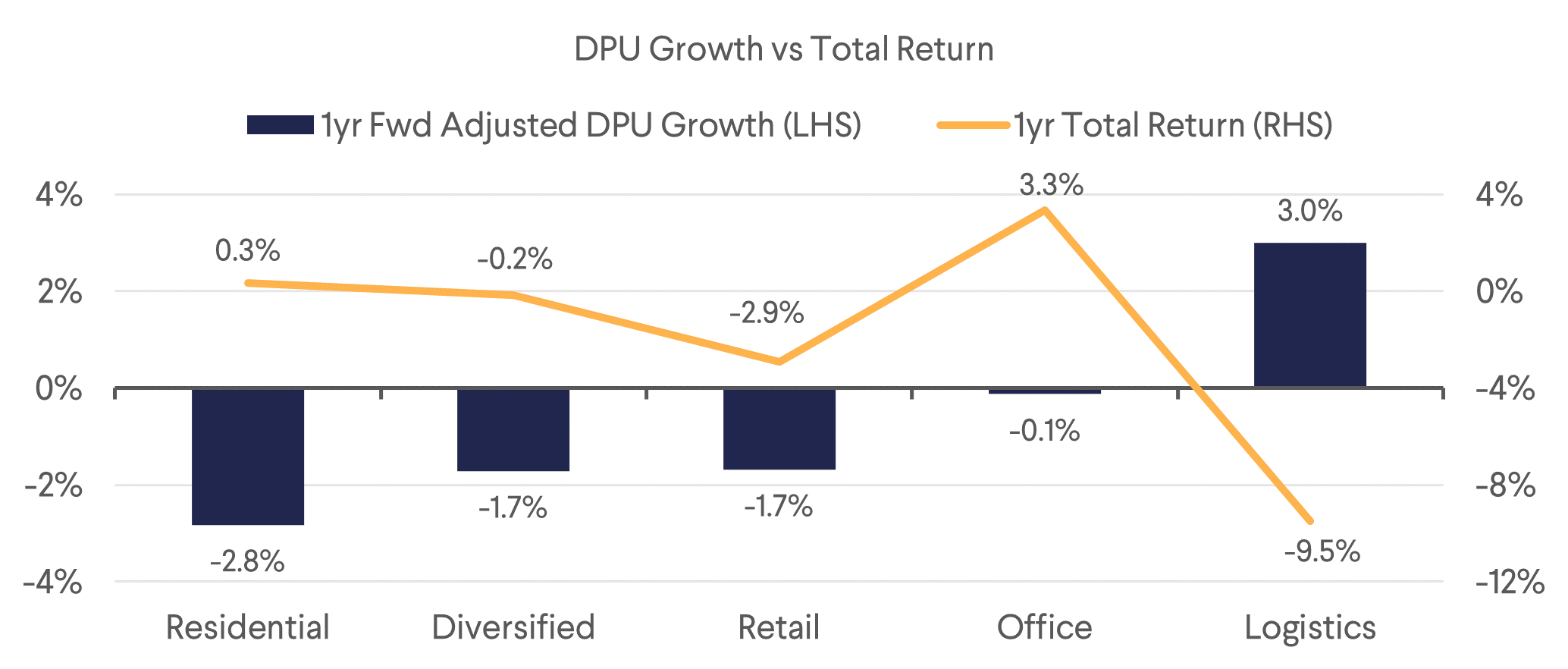

Logistics

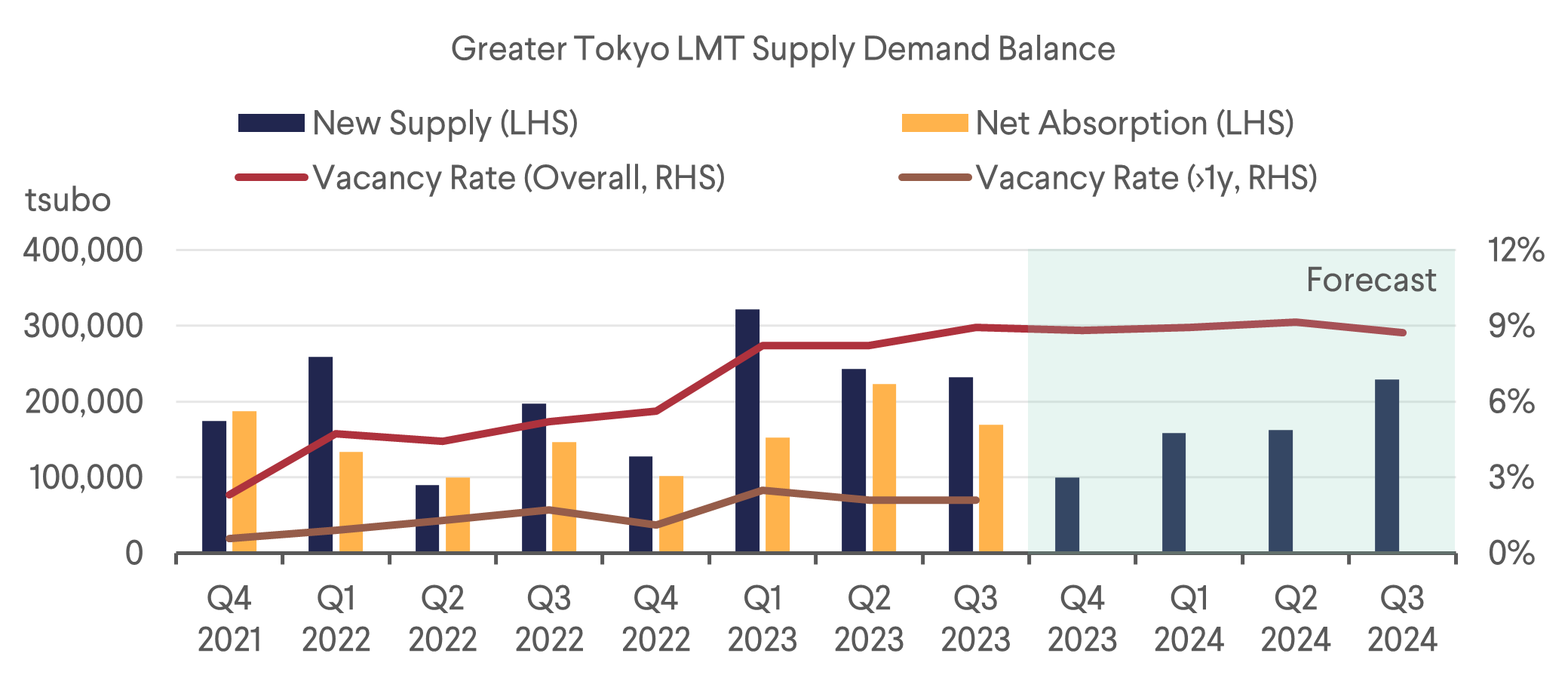

Logistics has been the worst-performing sector in 2023 despite having the strongest DPU growth apart from hotels. Investors are likely worried about the large supply and rising vacancy, as well as the impact of inflation as logistic leases are typically longer in duration. We think that this concern is unfounded. We believe that quality assets in good locations will continue to be in strong demand. When leases come up for renewal, they are often renewed at reversions higher than the rate of inflation. The REITs typically have long-duration debt (average 4yrs to maturity) and a high ratio of fixed rate debt. They are also able to control debt cost at refinancing by shortening the duration or by taking on some floating rate debt.

Source: B&I Capital, FactSet (As of 6/12/23. Adjusted DPU growth excludes one-time effects e.g. distribution of capital gain from asset sales.)

While the market vacancy rate in Tokyo for large multi-tenant (LMT) facilities is high at 8.9% as of 3Q23, vacancy rates for properties completed more than a year ago is low at 2.1%. Areas that have low supply and high demand such as the bay area and Chiba have very low vacancy rates.

Source: CBRE

Developers

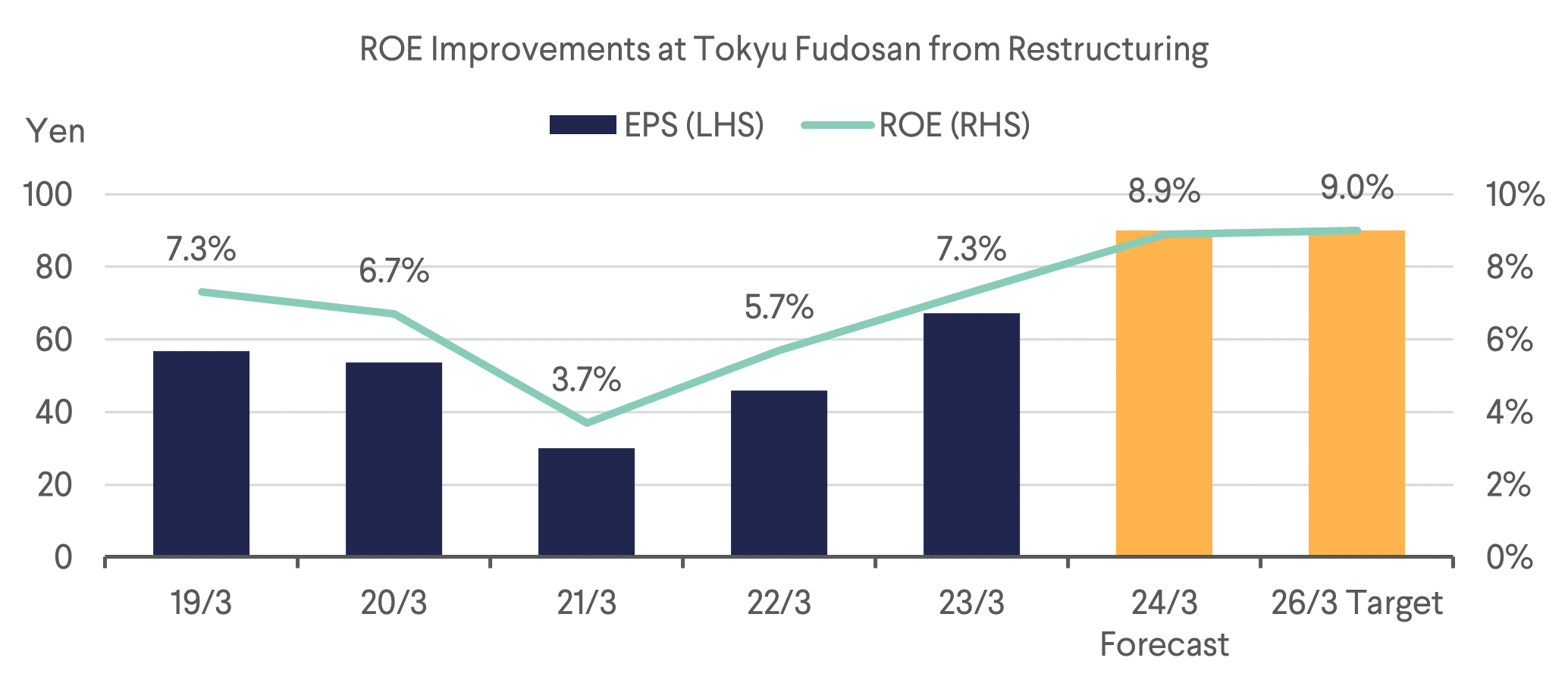

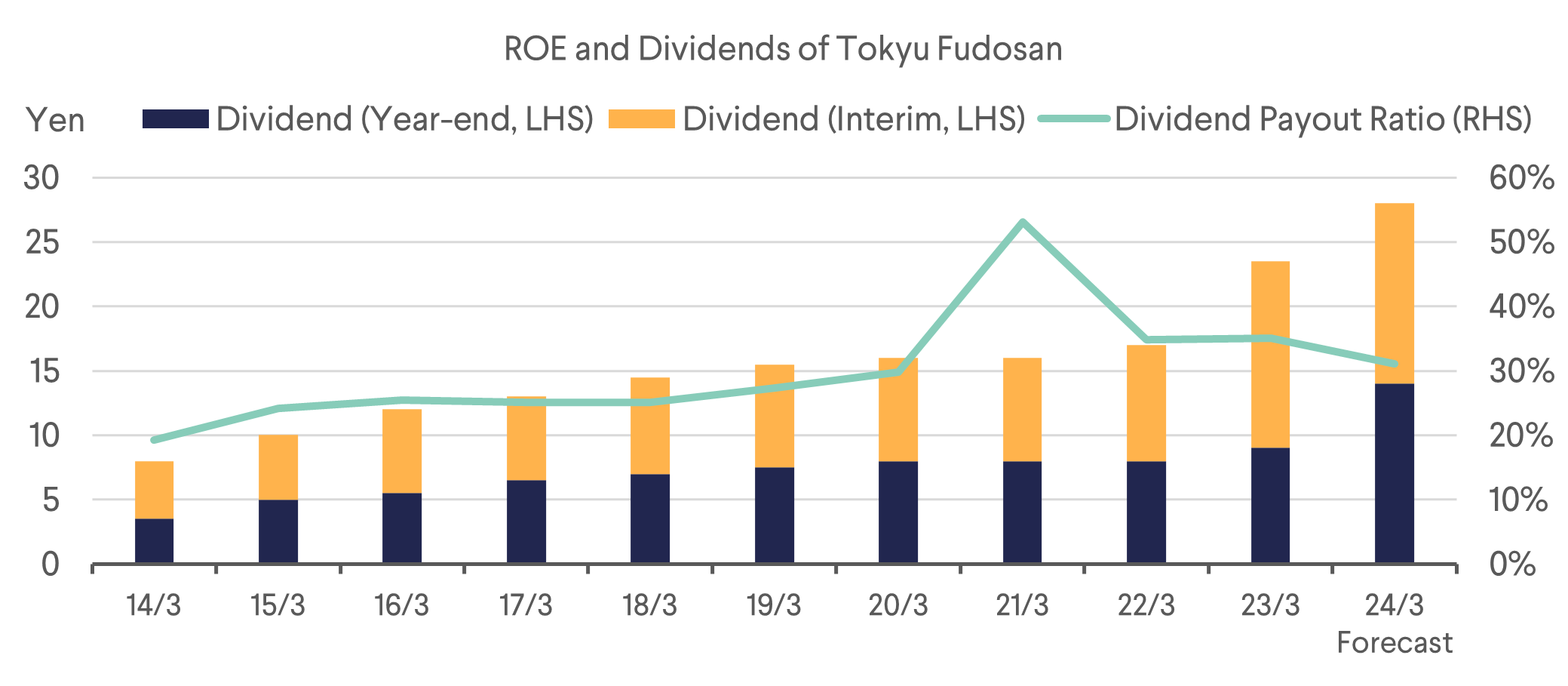

Developers have had a very strong year riding the tailwind of inflation expectations. Another factor driving some of the developers is the improving corporate governance which translates to better shareholder returns.

Tokyu Fudosan is currently amid portfolio restructuring to improve return on equity (ROE), and as a result increase its dividends. They have sold their loss-making businesses such as the Tokyu Hands retail business and fitness business. They have also sold some of their regional golf courses as well as urban retail properties that are less profitable. As a result of the restructuring, together with the recovery of their hotel and brokerage business, ROE is expected to improve from 7.3% pre-pandemic (FY 3/19) to 8.9% in FY 3/24. They are also expected to increase dividends almost 20% YoY.

Source: Tokyu Fudosan

Source: Tokyu Fudosan

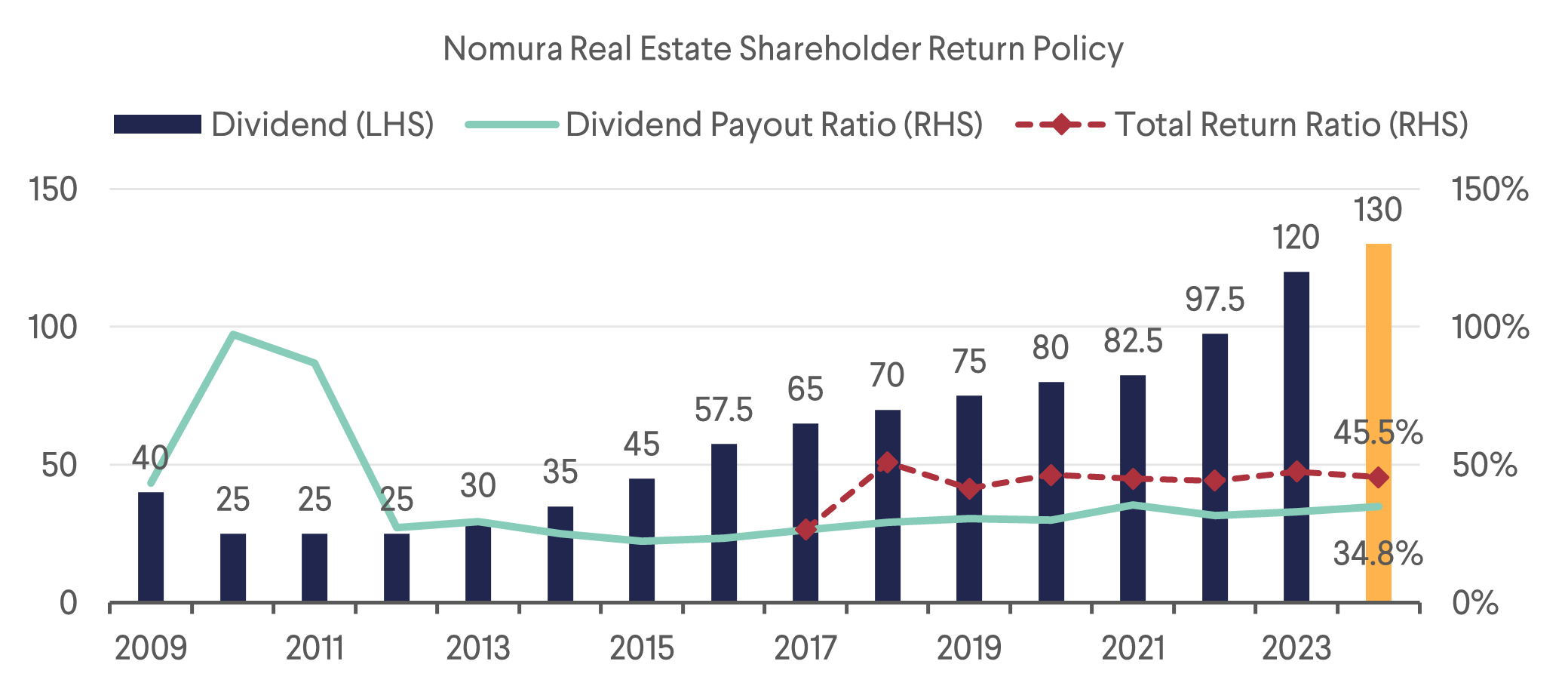

Nomura Real Estate Holdings (3231) has maintained a TSHR of c.45% and grown dividends at a CAGR of 15% in the past 10yrs.

Source: Nomura Real Estate Holdings

The domestic businesses of developers are generally doing well but cracks sometimes appear in their overseas portfolios (e.g. slower condo sales, impairments, etc.) While the impact typically is not large, we would prefer them to stick to domestic investments.

Download the PDF version of the report here