The Asset Management Association Switzerland and the Lucerne University of Applied Sciences and Arts (HSLU) invited 326 Swiss-based companies to participate in a survey for the Swiss Asset Management Study 2023. B&I Capital was one of the companies that took part in the survey which included a quantitative and qualitative questionnaire.

The total Asset Under Management of the participating companies represents 92% of assets in Switzerland showing that the survey participants are among the largest and most well-known asset management firms in Switzerland.

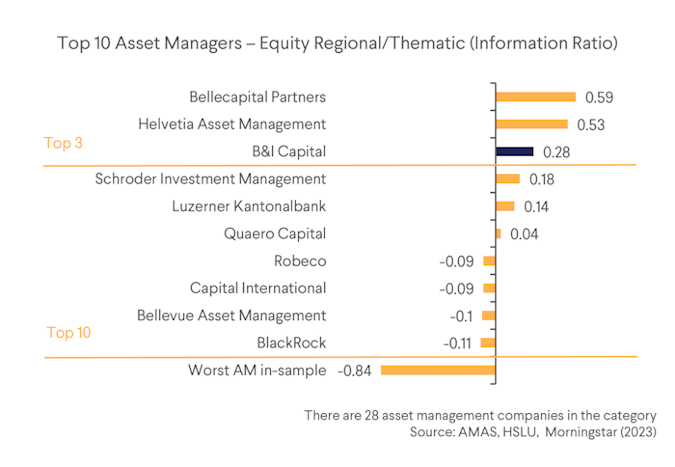

The study also performed a performance analysis based on public data from the Morningstar Direct database. The B&I Capital funds were assigned to the regional/thematic equity funds category, due to the fact that the benchmark assigned by Morningstar has a regional or thematic focus. The funds in the category were ranked based on the 5-year information ratio (IR) which measures the excess returns of a portfolio over the benchmark relative to the tracking error. B&I Capital ranked third from 28 asset managers within this category.

The study also highlighted other findings from the broader Swiss Asset Management industry. For instance, with respect to the occupational pension system, the asset management industry is an important contributor with approximately 32% of pension fund assets coming from net investment income since 2004. Furthermore, Swiss asset management also shows a strong business performance due to higher cost-efficiency.

Download the PDF version of the study here