1. Overview

We were in Tokyo from 1-5 December for a series of meetings and property tours organized separately by Nomura, SMBC Nikko and UBS. Our visit coincided with heightened geopolitical tensions between Japan and China, and the decline in Chinese tourist traffic on the streets was noticeable. While it is still early, both Invincible (8963) and Japan Hotel REIT (8985) have reported some cancellations, though the impact remains limited. Star Asia (3468), which has a sizable hotel portfolio, indicated that it was able to backfill Chinese cancellations at higher room rates. The real test will come over the Chinese New Year holiday period in February, when inbound demand from China is typically at its strongest. That said, we expect the increasing popularity of Japan among Western travellers to help offset any temporary softness in Chinese inbound volumes.

The public-listed real estate market in Japan has delivered a strong performance this year, led primarily by the developers. As of 5 December, the TOPIX Real Estate Index and the TSEREIT Index have returned 36.1% and 24.0%, including dividends, compared with a 23.6% gain in the TOPIX. Underpinning this outperformance is an exceptionally robust real estate market characterised by rising rents supported by firm demand and constrained supply. The dominant macro theme driving this recovery is the extremely tight labour market, which has exerted material influence on both the demand and supply sides of the sector.

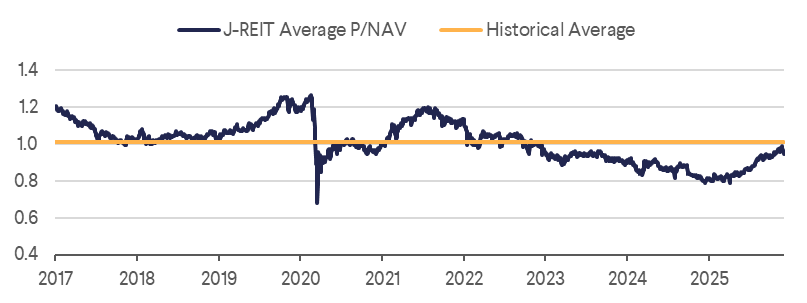

While the average J-REIT discount to NAV has narrowed markedly — from roughly 20% at the start of the year to about 5% as we approach year-end—the recovery has been far from uniform. REITs that have demonstrated an ability to grow earnings despite rising interest costs have led performance. This reality has prompted many J-REITs to adopt explicit DPU/EPU growth targets of 2–3% over the coming years. Consequently, sectors with cyclical tailwinds — particularly Office, Hotels, and Diversified REITs with exposure to these segments, as well as urban retail —have been the key outperformers.

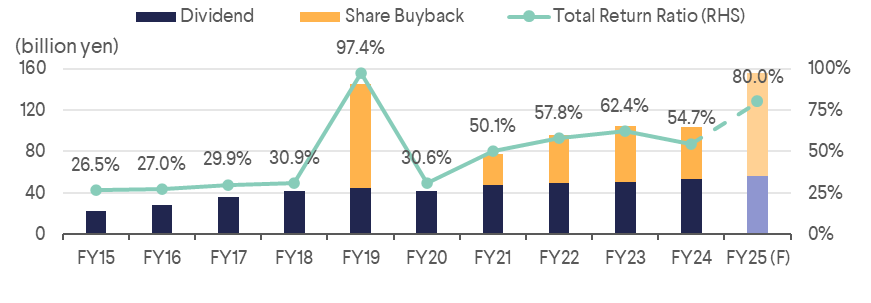

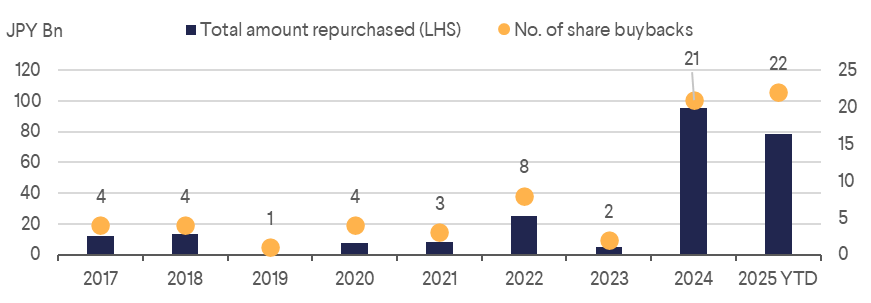

The developers — viewed as an effective hedge against inflation given the transactional nature of their business models — have delivered exceptionally strong performance this year. The Big Three developers, Mitsui Fudosan (8801), Mitsubishi Estate (8802), and Sumitomo Realty (8830), have returned 41%, 50%, and 67%, respectively, including dividends as of 5 December. Beyond benefiting from robust real estate fundamentals, the group has also been bolstered by an intensifying focus on shareholder returns. Mitsui Fudosan and Mitsubishi Estate, in particular, appear to be engaged in a competitive escalation, with both announcing ¥100 billion share buyback programmes this year. Mitsubishi Estate is also widely expected to increase the scale of its buybacks before their fiscal year-end in March, supported by gains from the sale of fixed assets and cross-shareholdings.

2. Major Takeaway

2.1 Workforce Scarcity Emerging as a Key Real Estate Market Shaper

Intensifying competition for talent is prompting companies to improve their workplace environments, driving a willingness to pay premium rents for high-end office spaces in prime locations. The shortage of workers and drivers, combined with a recent labor law restricting overtime hours, has also led to a bifurcation of the logistics market where warehouses with good access to labor and transport nodes are in high demand while properties in less desirable locations are facing leasing difficulties even a year after completion.

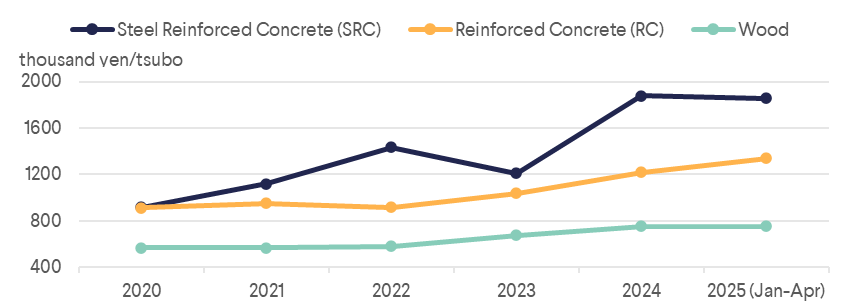

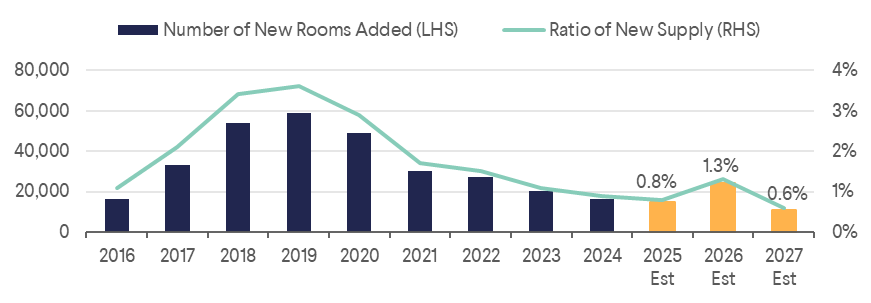

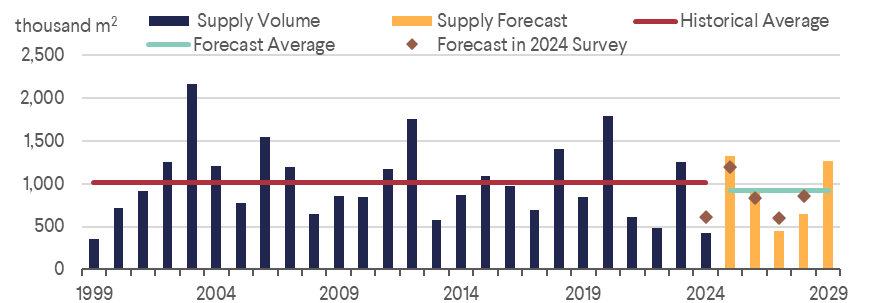

On the supply side, lack of skilled labor together with increased material costs resulting from the weak yen has dramatically increased development costs. While existing projects are not impacted as contract values are typically fixed before the start of construction, projects that have not broken ground face the risk of lower margins or might have to be cancelled altogether. In many cases, economic rents need to be 20-30% higher than current market rents for developments to be viable. In the hotel sector where strong operating profitability can justify development, supply is still very low at about 2% of stock over the next 2 years as developers struggle to secure operators who are constrained by staffing shortages.

In a typical real estate cycle, rising rents incentivize developers to ramp up construction, eventually leading to oversupply and downward pressure on rents. In the current cycle, however, we believe this supply response will be meaningfully delayed due to the structural constraints outlined above. Moreover, we expect construction costs to continue rising, as there is no near-term solution to the shortage of skilled construction labor. While the pace of foreign labor inflows has increased, it remains insufficient to meaningfully close the gap between supply and demand."

2.2 Sustained Momentum in Office Market

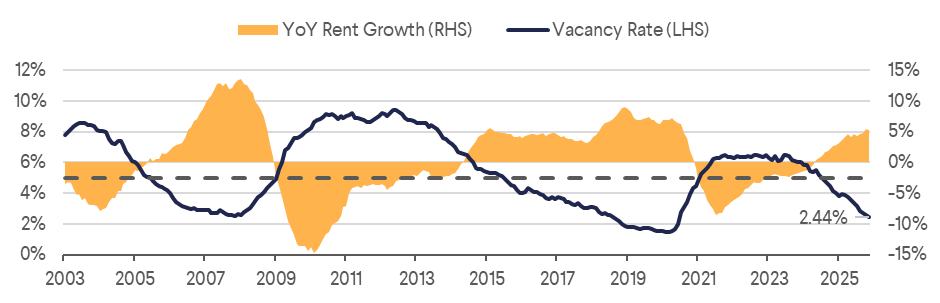

Office vacancy in the prime central five wards of Tokyo has decreased from a post pandemic high of about 6.5% to below 2.5% in November according to the monthly Miki Shoji office market survey. The same survey also reported asking rents increasing 5.3% YoY. Intensifying competition for talent is prompting companies to improve their workplace environments but with low market vacancy and limited new supply, they are increasingly willing to pay higher rents for these prime office spaces.

Supply coming in 2026 and 2027 are already around 80% and 40% pre-leased respectively. Mitsubishi Estate’s (8802) Tokyo Torch Tower in Marunouchi, which makes up majority of the supply coming in 2028, is leasing well according to the developer. The project was initially underwritten at rents of JPY 40-45k/tsubo, actual leasing started at JPY 50k/tsubo and they believe they can achieve top rents of JPY 70k/tsubo. Mitsui Fudosan (8801) during their recent 2Q results announcement claimed that rents of JPY 100k/tsubo is now “within sight”, referring to their development project in Yaesu, a location generally regarded as slightly secondary in prestige to the Marunouchi/Otemachi core. While projected supply is expected to spike in 2029, we might see some projects postponed or cancelled if construction costs continue to rise.

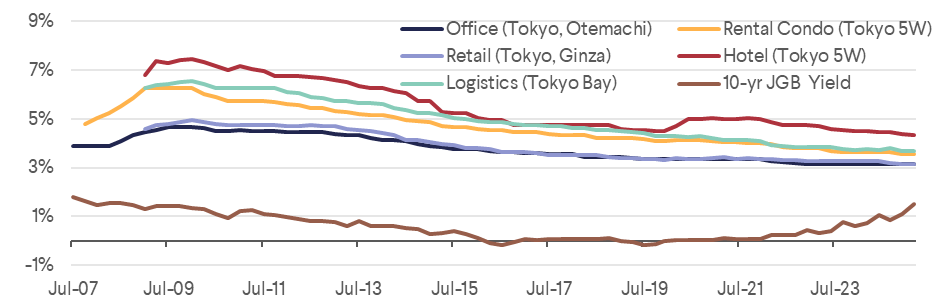

2.3 Real Estate Market Remains Robust Despite Rising Rates

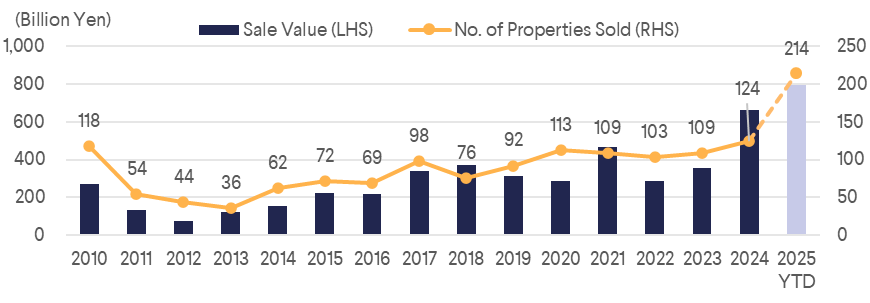

Cap rates have continued to compress even as 10-year JGB yields have risen from near zero to just under 2 percent over the past five years. Despite the prospect of higher interest rates, Tokyo ranked as the world’s largest real estate investment market in 2024, with commercial property transactions totalling approximately USD 34bn, according to Jones Lang LaSalle (JLL). Tokyo remains a leading contender in 2025, supported by landmark transactions such as Blackstone’s JPY 400bn (USD 2.6bn) acquisition of Tokyo Garden Terrace Kioicho from Seibu Holdings, and Gaw Capital and Patience Capital’s joint acquisition of Tokyu Plaza Ginza for more than USD 1bn. According to CBRE, commercial real estate transaction volume in Japan reached just under JPY 5tn in the first three quarters of this year.

JREITs for the most part have been trading at a discount to NAV and have taken the opportunity to sell non-core assets into this strong market, distributing capital gains and re-allocating proceeds into better assets or share buybacks. We saw a record level of buybacks by JREITs in the past 2 years, reflecting a good understanding of cost of capital. Looking ahead, some cap rate expansion may occur as long-term yields continue to rise, and a wider spread could create additional opportunities for J-REITs to pursue accretive acquisitions.

2.4 Inflation Accepted as Lasting Reality

Japanese society has increasingly come to accept that inflation is here to stay after decades of deflation. This significant shift in mindset is evident across daily life, from the broad acceptance of higher prices in supermarkets and restaurants to a greater willingness among individuals and businesses to agree to higher rents. Even in the residential segment, where lease renewals have traditionally been highly protective of tenants, J-REITs report that renters are now more open to negotiation. More proactive REITs are securing rent increases on roughly 50–60% of renewals. CPI-linked rent clauses, initially introduced in long-duration logistics leases, are also beginning to appear in fixed-term office leases as landlords seek to inflation-proof their portfolios.

3. Conclusion

In the years of deteriorating share prices from 2022 through the early-stage recovery this year, J-REIT management teams have navigated a highly challenging and constantly shifting environment with commendable discipline. These conditions have tested their understanding of the true cost of capital and forced more rigorous capital-allocation decisions. For investors, the period has provided clearer insight into management quality, revealing meaningful dispersion across the sector. Even so, we believe the J-REIT market as a whole has emerged more resilient, with stronger operating discipline and a more measured approach to capital deployment.

Developers have also made notable progress on corporate governance and shareholder alignment, albeit to varying degrees. Mitsubishi Estate, in particular, has made significant strides in recent years. The company has set a medium-term target of achieving a 10% ROE by 2030 and has committed to accelerating the sale of fixed assets and cross-shareholdings, alongside meaningful share buybacks, to support this objective. Sumitomo Realty has adopted similar measures, though without an explicit ROE target and at a considerably smaller scale relative to Mitsubishi Estate. Supported by favourable fundamentals, improving capital efficiency, and attractive valuations, developers remain an appealing asset class.

Despite the strong share price performance across the listed real estate sector this year, we believe the rally still has further room to run. Expected rent growth — supported by favourable supply–demand dynamics — combined with undemanding valuations and continued improvements in corporate governance, provides a solid foundation for additional upside. That said, selectivity remains essential, particularly within the J-REIT space. Rising interest costs pose a meaningful headwind, and REITs unable to grow revenue at a sufficient pace risk being left behind.

It is encouraging that recent public offerings by Nippon Building Fund (8951), United Urban (8960), and Japan Prime (8955) were well received, reflecting healthy investor appetite for accretive transactions. Should the recovery momentum continue, we should see J-REITs get into the position to raise equity again and get back to a virtuous cycle of external growth which has eluded the sector for the past three years.

Download the PDF version of the report here