Interest Rate & Performance

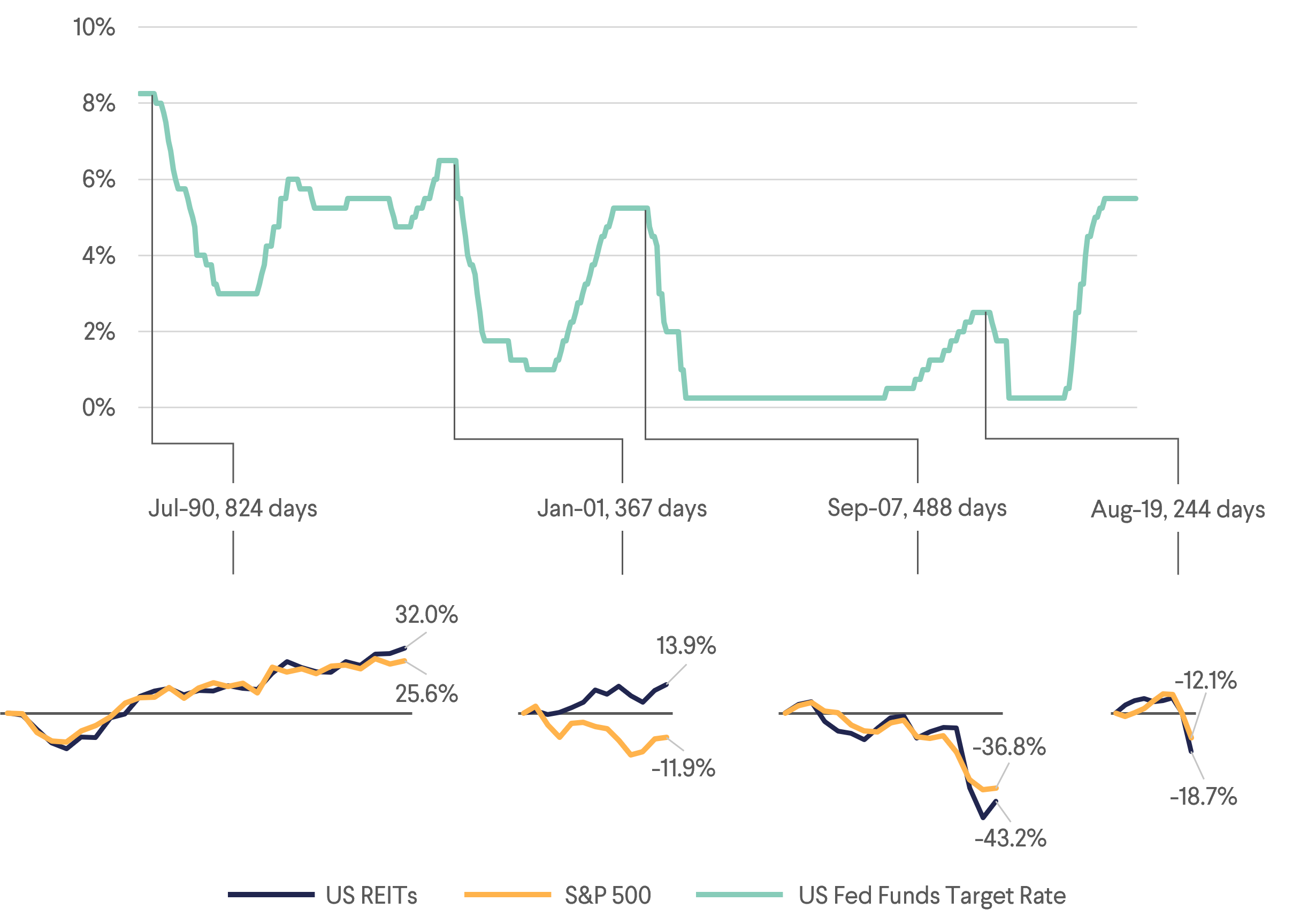

Triggered by falling rates, REITs have recently experienced a recovery from oversold territory. However, even as the market is expecting further rate cuts from the Federal Reserve, we remain cautious about basing investment decisions solely on interest rate forecasts. Figure 1 shows that REITs and S&P 500 performance was mixed during periods of falling interest rates. For instance, the rate cuts during the Great Financial Crisis and Covid-19 coincided with negative years for REITs and S&P 500, contrary to the common belief that lower interest rates are always favourable for equities.

In contrast, during periods of increasing interest rate, we actually see occasions where equities showed positive performance as shown in Figure 2 below. In May 2004, the Federal Reserve began raising rates over a span of 760 days, during which REITs significantly outperformed the S&P 500 by 44.9%. In practice, according to Nareit, there has generally been a positive association between periods of rising rates and absolute REIT returns over longer periods. Our key takeaway is that investing in REITs is not merely a bet on interest rates, as some market commentators suggest.

The Effect of Interest Rate on REITs

The Discounted Cash Flow (DCF) model offers an explanation on how businesses generate value and REIT long term share performance. The DCF model includes several variables, but we focus on the two main value drivers here: discount rates (a derivative of interest rates) and business cash flows. The impact of market interest rates on a REIT’s valuation, is driven by the discount rates and cash flows and their interaction. The theory states that a lower discount rate increases the DCF value, assuming cash flows remain constant.

We acknowledge the positive impact that lower interest rates can have on REITs’ cost of capital, which can create opportunities for additional growth through acquisitions. However, the effect of market interest rates on the cash flows of a business can be less straightforward since only a small portion of debt is repriced annually. On the other hand, rising interest rate might reflect improvement in the underlying fundamentals. A stronger economy leads to both higher occupancy and rental rates resulting in better profits and dividends for shareholders. Additionally, rising interest rates might also limit new construction, which benefits existing owners of real estate through reduced supply.

The complex interaction of these factors and the figures above show that even if investors can anticipate the change in interest rates, it might not necessarily lead to the right investment decision. Therefore, instead of attempting to predict the direction and magnitude of interest rate moves, B&I Capital emphasizes evaluating the business models and fundamentals of REITs.

Positive Fundamentals for REITs

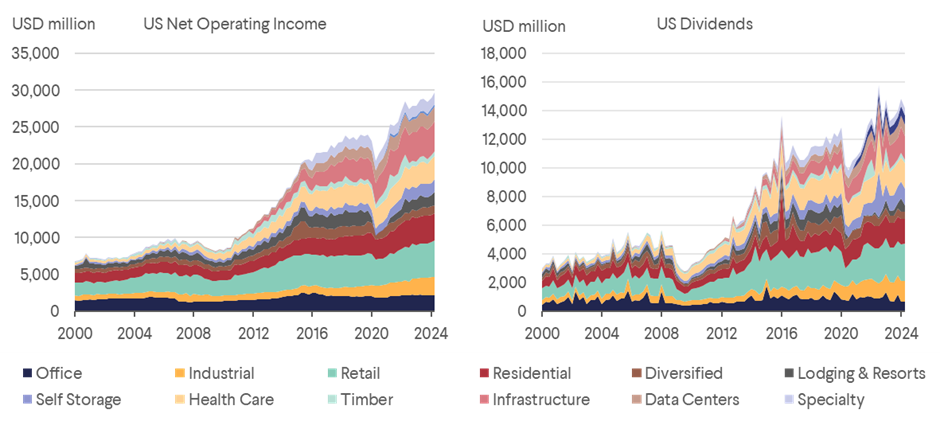

We focus on REITs with solid business models, good balance sheets, and proven management teams, evaluating companies based on their expected total return (dividend yield plus dividend growth) and favour REITs with higher total return expectations. Figure 3 shows that US REITs are currently enjoying solid long-term fundamentals based on Net Operating Income (NOI) and dividend growth.

These numbers are supported by our discussions with REIT management teams. As an example, Four Corners’ REIT CEO, Bill Lenehan, highlights a strengthening acquisition market, evidenced by their recent purchase of 19 Bloomin' Brands restaurant properties for USD 66 million. Healthcare REIT Welltower has also engaged in significant external growth even through an elevated interest rate environment, having deployed USD 4.9bn in 2024 as of their July business update.

We believe that our emphasis on traditional fundamental analysis offers deeper insights into the underlying business drivers and long-term capital growth. This disciplined approach provides prudent investors with a more robust framework for making informed and profitable decisions in the REIT sector. At B&I Capital, our focus remains on leveraging these fundamentals to guide our long-term investment decisions and strategy.

Download the PDF version of the article here